As a small business owner, I know how exciting and fulfilling the entrepreneurial journey can be. However, I also understand the inherent risks that come with starting and running your own venture. That’s why one of the most crucial steps in protecting your business is securing the right insurance coverage. In this article, I’ll guide you through the ins and outs of small business general liability insurance, explaining why it’s essential and how to find the coverage that best suits your unique needs.

Toc

- 1. Embracing Risk Management: The Power of General Liability Insurance

- 2. Understanding the Protection Offered by Small Business General Liability Insurance

- 3. Navigating the Cost Landscape: Factors That Influence Your Premiums

- 4. Related articles:

- 5. Securing the Right Coverage: Strategies for Finding the Best Value

- 6. Proactive Risk Management: Strategies for Minimizing Premiums

- 7. Q: Is general liability insurance required by law for all small businesses?

- 8. Q: How much does general liability insurance typically cost for a small business?

- 9. Conclusion: Safeguarding Your Small Business, Empowering Your Future

Embracing Risk Management: The Power of General Liability Insurance

General liability insurance is the cornerstone of risk management for small businesses like ours. This policy safeguards your company against third-party claims for bodily injury, property damage, and even personal or advertising-related incidents. Imagine a scenario where a customer slips and falls on your premises, breaking their wrist. Without the right insurance, you’d be responsible for the medical expenses and any related legal fees. But with general liability coverage, your insurer would handle the legal defense and settlement costs, preventing a potentially devastating financial impact on your business.

General Liability Insurance

General Liability Insurance

As an entrepreneur, general liability insurance provides the peace of mind you need to focus on growing your company without constantly worrying about potential lawsuits. It’s a prudent investment that can also demonstrate your professionalism and build trust with clients, partners, and suppliers. Many organizations may even require you to have this coverage before they’ll work with you, so it’s a smart move that can open doors and expand your business opportunities.

Understanding the Protection Offered by Small Business General Liability Insurance

General liability insurance offers a range of coverage types to address the diverse risks faced by small businesses like ours. Let’s dive into the key protections you should consider:

Premises Liability Coverage

If your business operates from a physical location, premises liability coverage is essential. This protection safeguards your company against claims arising from accidents or incidents that occur on your property, such as slips, trips, and falls. Whether it’s a customer, client, or even a vendor, this coverage ensures your business is protected from the financial burden of related medical expenses and legal costs.

Business people smile as they discuss general liability insurance in an office.

Business people smile as they discuss general liability insurance in an office.

Products Liability Coverage

For businesses that manufacture, distribute, or sell products, products liability coverage is a must-have. This protection shields your company from claims related to defects, mislabeling, or faulty design that could potentially cause injury or property damage to your customers. It’s a critical safeguard against the risks associated with the goods and services your business provides.

Personal and Advertising Injury Liability Coverage

In today’s digital landscape, where marketing and advertising play a crucial role in business growth, personal and advertising injury liability coverage is essential. This protection covers your company against claims of libel, slander, copyright infringement, and other offenses that can arise from your marketing and advertising activities, both online and offline. It helps safeguard your brand’s reputation and mitigate the financial risks of such claims.

Cyber risks and your business.

Cyber risks and your business.

By understanding the specific coverage types offered by general liability insurance, you can tailor your policy to address the unique risks your small business faces, ensuring comprehensive protection for your entrepreneurial venture.

When it comes to the cost of small business general liability insurance, several factors come into play. As an experienced small business owner, I’ve learned that it’s crucial to consider these elements to ensure you’re getting the best value for your investment.

Industry and Risk Factors

The industry in which your business operates is one of the primary drivers of your insurance premiums. Generally, industries with higher risk profiles, such as construction or healthcare, tend to face higher premiums compared to lower-risk sectors like professional services or technology. Additionally, businesses with a history of claims or the potential for high-risk activities may also see higher premiums.

Location and Business Size

The location of your business can also impact your general liability insurance costs. Businesses in high-crime areas or with high foot traffic may pay higher premiums due to the increased risk of accidents or incidents. Similarly, larger businesses with more employees and operations typically pay higher premiums than smaller, less complex organizations.

Coverage Limits and Deductible

The coverage limits and deductible you choose for your general liability insurance policy can significantly affect the overall cost. Higher coverage limits, which represent the maximum amount the insurer will pay, generally result in higher premiums. On the flip side, a higher deductible, the amount you pay out-of-pocket before the insurance coverage kicks in, can lead to lower premiums.

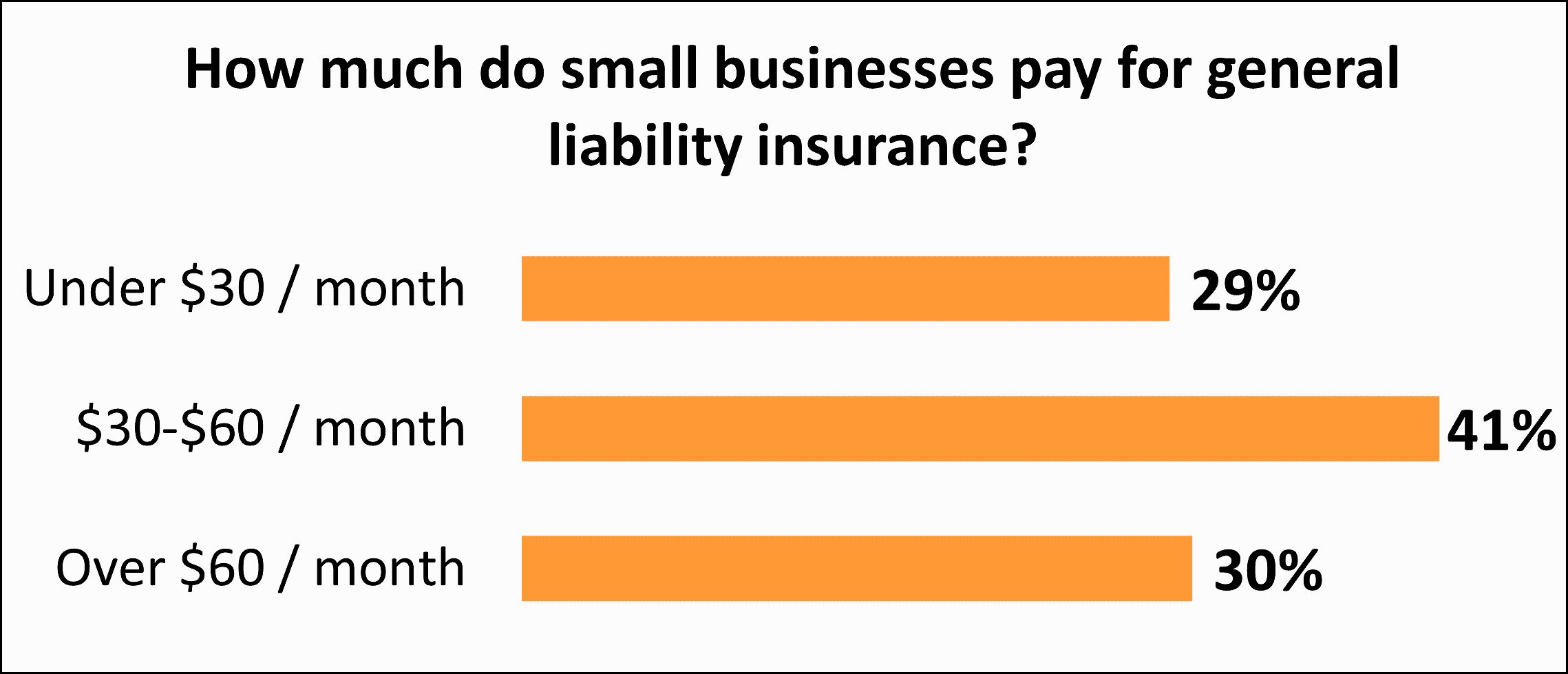

How much do small businesses pay for general liability insurance with Insureon?

How much do small businesses pay for general liability insurance with Insureon?

When selecting your coverage limits and deductible, it’s essential to strike a balance between the level of protection you need and the affordability of your premiums. Consider your potential risks and financial capacity to determine the optimal combination that best suits your small business.

Securing the Right Coverage: Strategies for Finding the Best Value

As an entrepreneur, I understand the importance of making informed decisions when it comes to protecting your business. That’s why I’m passionate about sharing the strategies I’ve learned for finding the right small business general liability insurance coverage at the best value.

Comparison Shopping: The Key to Informed Decisions

To ensure you’re getting the most comprehensive and cost-effective general liability insurance for your small business, it’s crucial to compare quotes from multiple providers. Utilize online comparison tools or work with an insurance broker to request quotes from at least three reputable insurers. This will allow you to evaluate factors like coverage, price, and customer service to make an informed decision that aligns with your unique needs.

Bundling for Potential Savings

Many insurance providers offer discounts for purchasing multiple policies, such as general liability, commercial property, and workers’ compensation, in a bundle. This is often referred to as a business owners policy (BOP), which combines general liability and commercial property insurance into a single package. Bundling your insurance policies can result in significant savings on your premiums, so it’s a strategy worth exploring.

Exploring Additional Coverage Options

While general liability insurance is a cornerstone of risk management, your small business may have specific risks that require additional coverage options. For example, if you provide professional services, you may need to consider errors and omissions (E&O) insurance, also known as professional liability insurance, to protect against claims of professional negligence or errors.

Take the time to evaluate your industry, the services you offer, and any unique risks your business faces, and consult with an insurance professional to determine if additional coverage is necessary. This comprehensive approach will help you build a robust insurance portfolio that truly safeguards your entrepreneurial venture.

Proactive Risk Management: Strategies for Minimizing Premiums

As a small business owner, I’ve learned that proactive risk management is not only essential for protecting your company but can also potentially help reduce your insurance premiums. By implementing strong risk management practices, you can demonstrate to your insurance provider that your business is a lower-risk investment, potentially leading to more favorable rates.

Prioritizing Safety and Security

One of the most effective ways to manage risks and potentially lower your general liability insurance premiums is to prioritize safety and security within your business. This includes regularly conducting safety inspections, providing comprehensive training for your employees, developing clear policies and procedures, and implementing robust security measures to protect your property and data. By taking these proactive steps, you can show your insurer that your business is committed to minimizing risks, which may translate into more favorable premiums.

Maintaining a Clean Claims History

Keeping your claims history clean and well-documented is another critical factor in managing your small business general liability insurance costs. Avoid filing unnecessary claims and address potential issues proactively to prevent claims from arising in the first place. Work closely with your insurance provider to understand their claim procedures and best practices, which can help you manage your claims effectively and maintain a positive claims record.

Exploring Discounts and Incentives

Insurance providers often offer various discounts and incentives to help small businesses like ours manage their insurance costs. Be sure to ask about discounts for bundling policies, implementing safety programs, or maintaining industry affiliations. Additionally, consider paying your premiums annually instead of monthly, as this may result in additional savings.

By combining these proactive risk management strategies with a comprehensive understanding of the insurance landscape, you can position your small business for long-term success and protect your entrepreneurial dreams with the right general liability insurance coverage.

Q: Is general liability insurance required by law for all small businesses?

A: General liability insurance is not always legally required, but it’s highly recommended for most businesses. Certain industries, states, or contracts may require it, so it’s essential to research the specific requirements for your small business.

Q: How much does general liability insurance typically cost for a small business?

A: The average cost of small business general liability insurance can vary based on factors like industry, location, and coverage limits. Generally, small businesses can expect to pay anywhere from $30 to $60 per month for this coverage.

Conclusion: Safeguarding Your Small Business, Empowering Your Future

As a fellow small business owner, I can attest to the immense value that general liability insurance brings to the entrepreneurial journey. By understanding the comprehensive coverage it provides, the factors that influence its cost, and the strategies for finding the right policy, you can take proactive steps to safeguard your business and focus on achieving your goals with confidence.

Remember, securing the right general liability insurance coverage is not just a wise investment – it’s a testament to your commitment to risk management and your dedication to your entrepreneurial vision. So, reach out to a reputable insurance provider today, explore your options, and take that crucial step towards protecting your small business and empowering your future.