Real Estate E&O Insurance: A Vital Shield for Your Business

Toc

- 1. Understanding the Importance of Real Estate E&O Insurance

- 2. Customizing Your E&O Coverage

- 3. Related articles 01:

- 4. Proactive Risk Management: A Winning Approach

- 5. Weathering the Storm: How E&O Insurance Has Got Your Back

- 6. Embracing the Future with Confidence

- 7. Related articles 02:

- 8. How much does real estate E&O insurance typically cost?

- 9. What are the benefits of having E&O insurance for real estate professionals?

- 10. How can I find a reputable E&O insurance provider for my real estate business?

- 11. What should I do if I am sued for an error or omission in my real estate business?

- 12. Conclusion

As a seasoned real estate professional, I’ve witnessed firsthand the importance of safeguarding your business with the right insurance coverage. In an industry where opportunities abound, the risks of errors and omissions are ever-present, and the consequences can be financially and reputationally devastating. That’s why real estate E&O insurance has become an indispensable tool in my arsenal.

The U.S. real estate market was valued at over $110 trillion in 2022, and the demand for our services continues to soar. However, with this growth comes an increased vulnerability to potential lawsuits. Whether it’s a misrepresentation of property details, a failure to disclose material information, or an unintentional oversight, even the most diligent real estate professionals can find themselves embroiled in costly legal battles.

Understanding the Importance of Real Estate E&O Insurance

Real estate E&O insurance is designed to shield us, as professionals, from the financial burden of such claims. It provides comprehensive coverage against a wide range of potential liabilities, including allegations of negligence, breach of contract, and personal injury or property damage that may occur during a real estate transaction or property showing.

One of the key benefits of E&O insurance is its retroactive protection. This means that it covers claims that may arise from past transactions, offering invaluable peace of mind and protecting the hard-earned reputation we’ve built over the years.

Customizing Your E&O Coverage

When it comes to selecting the right E&O insurance policy, it’s crucial to consider the unique needs and risks associated with your real estate business. Factors such as the size of your operation, the types of services you offer, and the geographic region in which you operate can all influence the appropriate coverage limits and deductibles.

Working closely with a reputable insurance provider that specializes in real estate E&O can help you navigate the nuances of policy selection and ensure you’re adequately protected. They can provide valuable insights and guidance to help you tailor your coverage to your specific needs, giving you the confidence to focus on growing your business without the constant worry of potential claims.

1. https://goldnews24h.com/archive/4755/

2. https://goldnews24h.com/archive/4728/

3. https://goldnews24h.com/archive/4712/

Proactive Risk Management: A Winning Approach

While E&O insurance provides a safety net, I believe that real estate professionals should also take a proactive approach to risk management. Maintaining thorough documentation, communicating clearly with clients, and staying up-to-date on industry regulations and best practices can all help reduce the likelihood of errors and omissions.

By adopting a culture of risk awareness and continuous improvement, we can further safeguard our businesses and reputations. This proactive mindset not only minimizes the chances of claims but also demonstrates our commitment to excellence, which can be a valuable asset in the eyes of clients and industry peers.

Weathering the Storm: How E&O Insurance Has Got Your Back

Even with the best intentions and diligent practices, mistakes can still occur. When they do, real estate E&O insurance becomes an invaluable asset. It covers the legal fees associated with defending against claims, as well as any settlements or judgments that may be awarded to the aggrieved party.

This financial protection can mean the difference between weathering the storm and facing financial ruin. It allows us to navigate the challenges we face with confidence, knowing that our businesses are protected and our hard-earned reputations are secure.

Embracing the Future with Confidence

As the real estate industry continues to evolve, staying ahead of the curve with robust insurance coverage will be key to long-term success and sustainability. By investing in comprehensive E&O insurance, we can protect not only our businesses but also the interests of our clients, who entrust us with their most valuable assets.

In the dynamic and competitive world of real estate, errors and omissions are inevitable. But with the right insurance coverage and proactive risk management strategies in place, we can navigate these challenges with confidence and focus on what we do best: helping our clients achieve their real estate goals.

1. https://goldnews24h.com/archive/4722/

2. https://goldnews24h.com/archive/4728/

3. https://goldnews24h.com/archive/4755/

How much does real estate E&O insurance typically cost?

The cost of real estate E&O insurance can vary widely depending on factors such as the size of the business, the level of coverage needed, and the industry’s risk profile. Premiums can range from a few hundred dollars to several thousand dollars per year, depending on the specific requirements of the policy.

What are the benefits of having E&O insurance for real estate professionals?

The primary benefits of real estate E&O insurance include financial protection against lawsuits, coverage for legal fees and settlements, and preservation of the business’s reputation. It provides peace of mind for real estate professionals, allowing them to focus on serving their clients without the constant worry of potential claims.

How can I find a reputable E&O insurance provider for my real estate business?

When searching for an E&O insurance provider, it’s essential to look for a company with extensive experience in the real estate industry, a strong financial rating, and a proven track record of providing excellent customer service. Referrals from other real estate professionals or industry associations can be a great starting point in your search.

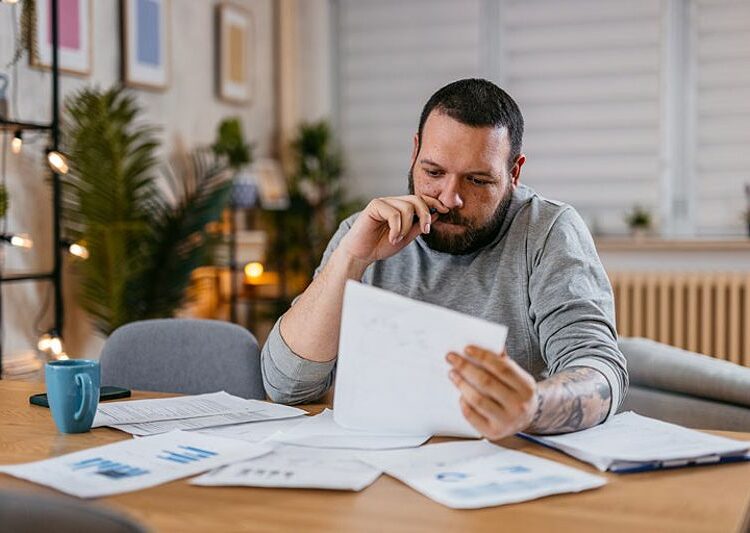

What should I do if I am sued for an error or omission in my real estate business?

If you are faced with a lawsuit, the first step is to immediately notify your E&O insurance provider. They will guide you through the claims process, provide legal representation, and work to resolve the matter. It’s crucial to cooperate fully with your insurance provider and follow their instructions to ensure the best possible outcome.

Conclusion

In the ever-evolving world of real estate, errors and omissions are an unavoidable reality. However, with the right insurance coverage in place, we can navigate these challenges with confidence and focus on delivering exceptional service to our clients. By investing in comprehensive real estate E&O insurance, we can protect our businesses, our reputations, and our financial well-being, ultimately paving the way for long-term success and sustainability.

As we move forward, I encourage you to evaluate your current insurance coverage and consider the benefits of a robust E&O policy. It’s a small investment that can make a world of difference in safeguarding your real estate business and ensuring your continued growth and prosperity.