In the dynamic world of small business, you face a relentless challenge — the ever-evolving threat of cyberattacks. As technology advances, so do the tactics of cybercriminals, putting your company’s data, finances, and reputation at risk. Cyber insurance for small business can be the powerful safeguard that shields your livelihood from the perils of the digital landscape.

Toc

Unmasking the Cyber Risks

Imagine the scenario: You’re the proud owner of a thriving local bakery, serving up delectable treats to your cherished community. One day, your system is held hostage by a ruthless ransomware attack, locking you out of your own data. Suddenly, your business grinds to a halt, and the costs of recovery start piling up. Or picture the sinking feeling as you discover that sensitive customer information has been breached, leading to a costly legal battle and a tarnished reputation.

These scenarios may sound like the stuff of nightmares, but they are all too real for small businesses like yours. According to a recent study, the average cost of a cybersecurity incident for a small business (with fewer than 50 employees) can range from $8,000 to $12,000, with some incidents costing as much as $300,000. The stakes are high, but with the right cyber insurance coverage, you can shield your hard-earned business from the devastating consequences of a cyberattack.

The Powerful Safeguard: Cyber Insurance for Small Business

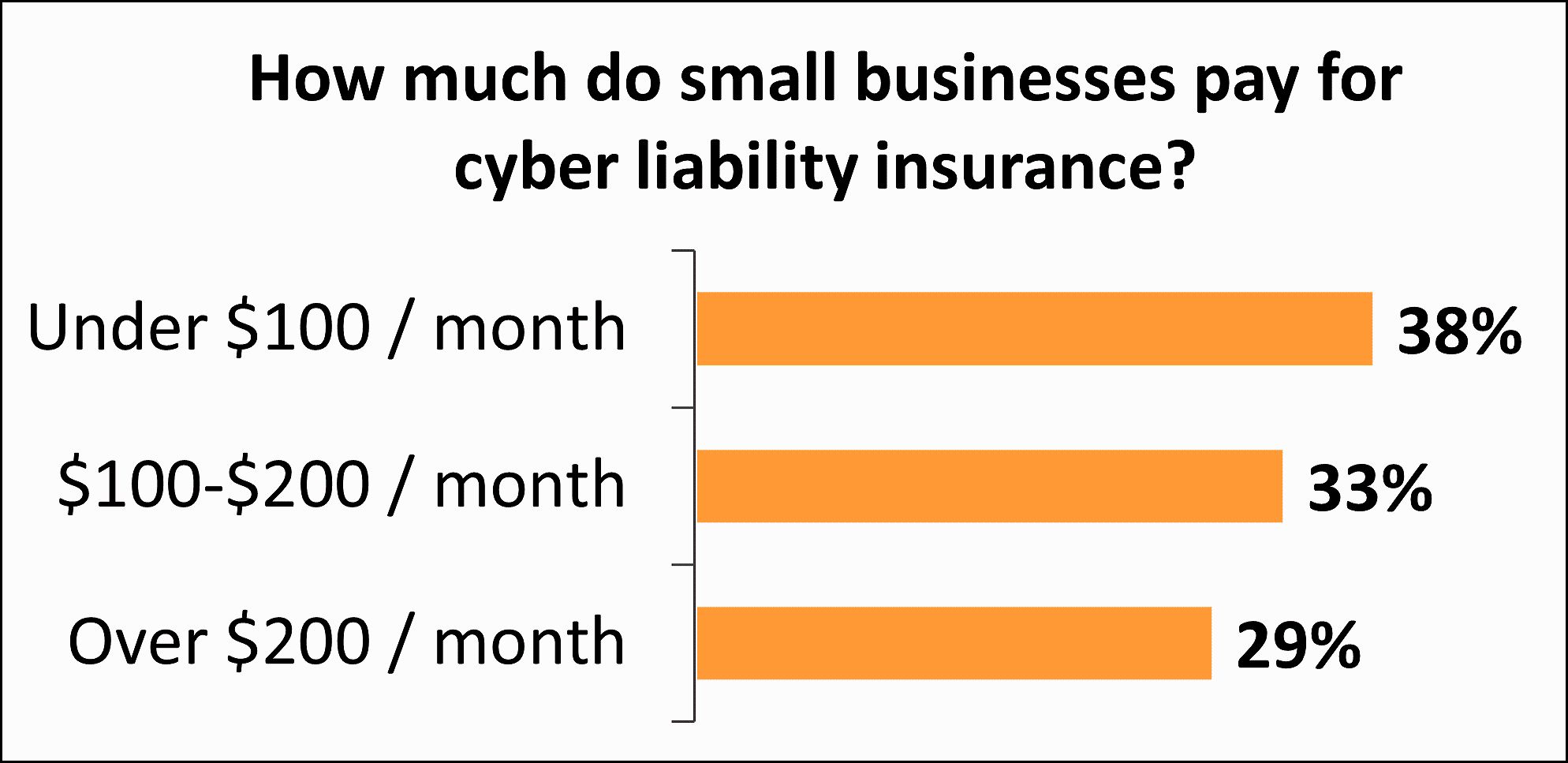

Cyber insurance costs in 2024 for small businesses

Cyber insurance costs in 2024 for small businesses

Cyber insurance is the powerful safeguard that can protect your small business from the financial and reputational devastation of a cyberattack. Imagine the peace of mind you’ll have, knowing that your business is covered for a wide range of cyber-related incidents, including:

Data Breach Coverage

If a data breach occurs, cyber insurance can help cover the costs of notifying affected customers, providing credit monitoring services, and addressing any legal or regulatory requirements. This can prevent a data breach from becoming a crippling financial burden.

Ransomware Protection

Ransomware attacks are on the rise, and they can bring your operations to a grinding halt. With cyber insurance, you can have the confidence that your business can recover from a ransomware attack, with the costs of paying the ransom and restoring your data covered.

Business Interruption

When a cyber incident disrupts your operations, cyber insurance can help recoup lost income and cover the expenses associated with restoring your systems and data. This can be a lifeline, ensuring that you can get back on your feet and continue serving your customers without missing a beat.

Cyber Extortion

Cybercriminals are increasingly using extortion tactics, threatening to publish or damage your data unless you pay a ransom. Cyber insurance can provide financial assistance and guidance to help you navigate these treacherous waters, giving you the support you need to stand firm against their demands.

Regulatory Compliance

In the event of a data breach or other cyber incident, your business may face regulatory actions and fines. Cyber insurance can help cover the costs of defending against these actions and paying any penalties, protecting your financial well-being and your hard-earned reputation.

Choosing the Right Cyber Insurance Policy

Average monthly cost of cyber liability insurance for Insureon customers

Average monthly cost of cyber liability insurance for Insureon customers

Selecting the right cyber insurance policy for your small business can feel like navigating a maze, but with the right guidance, you can find the coverage that fits your unique needs. Here are some key factors to consider:

Coverage Limits and Deductibles

Carefully assess your cyber risks and choose a policy with coverage limits that provide the robust protection your business requires. While higher coverage limits come with higher premiums, the peace of mind they offer can be priceless. Additionally, set a deductible that you can comfortably afford in the event of a claim.

Types of Coverage

Cyber insurance policies can include a range of coverage options, from first-party coverage (for direct losses to your business) to third-party coverage (for liability claims from customers or partners). Ensure that your policy aligns with the specific needs of your small business, safeguarding you on all fronts.

Exclusions and Limitations

Read the fine print and understand what is and isn’t covered by your cyber insurance policy. Some policies may have exclusions for certain types of incidents or damages, so it’s crucial to know what you’re getting before you need it.

Remember, working with an experienced insurance agent or broker can be invaluable in navigating the cyber insurance landscape and finding the right policy for your small business.

Strengthening Your Cyber Defenses

While cyber insurance is a crucial safeguard, it’s equally important to take proactive steps to enhance your cybersecurity measures. After all, prevention is always better than the cure. Here are some best practices to consider:

Stay Vigilant with Software Updates

Regularly updating your software and operating systems is one of the most effective ways to address known vulnerabilities and protect your systems from cyber threats. This simple yet powerful step can significantly reduce your risk of a successful attack.

Empower Your Employees

Educate your team about common cybersecurity risks, such as phishing scams, and equip them with the knowledge and tools to recognize and report suspicious activity. A well-informed workforce can be your first line of defense against cyber threats.

Conduct Regular Security Assessments

Invest in comprehensive security audits and penetration testing to identify and address any weaknesses in your IT infrastructure. This ensures that your defenses are always up-to-date and ready to withstand the ever-evolving tactics of cybercriminals.

By combining robust cybersecurity practices with the protection of a well-designed cyber insurance policy, you can transform your small business into a fortress that can weather any storm, digital or otherwise.

FAQ

Q: Is cyber insurance really necessary for all small businesses? A: Absolutely! In today’s digital landscape, every small business that relies on technology and stores customer data is at risk of falling victim to cybercriminals. Cyber insurance provides essential protection against the financial and reputational consequences of a cyber incident. It’s no longer a luxury, but a necessity for safeguarding your small business.

Q: How much does cyber insurance typically cost for small businesses? A: The cost of cyber insurance for small businesses can vary depending on factors such as your industry, the size of your company, and the coverage limits you choose. On average, small businesses can expect to pay anywhere from $1,000 to $7,500 annually for a comprehensive cyber insurance policy. While the cost may seem daunting, the protection it provides can be invaluable in the face of a cyberattack.

Q: What are some of the most common exclusions in cyber insurance policies? A: It’s important to carefully review the terms and conditions of any cyber insurance policy, as some common exclusions may include physical damage to hardware, loss of intellectual property, and long-term reputational damage. Knowing what isn’t covered can help you make an informed decision about the right policy for your small business and ensure that you have the protection you need.

Q: How can I find a reputable cyber insurance provider? A: When searching for a cyber insurance provider, look for companies with a proven track record in the industry, positive customer reviews, and financial stability. Consulting with an insurance agent or broker who specializes in cyber insurance can also be invaluable in helping you compare quotes and find the best policy for your small business. Taking the time to do your research can help you find a provider you can trust to safeguard your company.

Conclusion: Embrace the Cyber Safeguard

As a small business owner, you’ve poured your heart and soul into building your company. Why risk it all to the whims of cybercriminals? Cyber insurance is the powerful safeguard that can protect your livelihood, your reputation, and your peace of mind. By investing in the right cyber insurance coverage and complementing it with robust cybersecurity practices, you can focus on what truly matters — growing your business and serving your community with confidence.

In the ever-evolving digital landscape, cyber threats will continue to loom, but with the right tools and mindset, you can emerge stronger and more resilient than ever before. Embrace the power of cyber insurance and transform your small business into a fortress that can withstand any storm, digital or otherwise. Your success and prosperity are worth the investment — so don’t hesitate to shield your small business with the cyber safeguard it deserves.