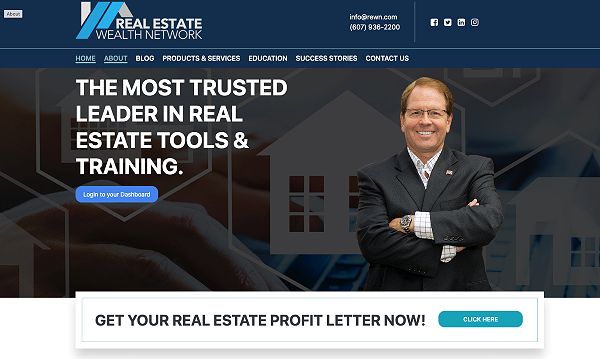

In the ever-evolving world of real estate investing, savvy professionals are constantly seeking innovative tools and resources to gain a competitive edge. One platform that has piqued the interest of many is the Real Estate Wealth Network, founded by the experienced real estate investor and entrepreneur, Cameron Dunlap. But beyond the surface-level hype, what does this network truly offer, and is it worth exploring for seasoned investors? To access the platform and explore its offerings, investors can visit the Real Estate Wealth Network login page.

Toc

- 1. Navigating the Real Estate Wealth Network Login: A Critical Examination

- 2. Uncovering the Motivated Seller Data Feed: A Double-Edged Sword?

- 3. Related articles 01:

- 4. Streamlining or Complicating? A Closer Look at iFlip

- 5. Evaluating Cameron Dunlap’s Inner Circle: Exclusive or Elitist?

- 6. Real Estate Wealth Network: A Comprehensive Evaluation

- 7. Navigating the Real Estate Wealth Network: A Critical Approach

- 8. Related articles 02:

- 9. FAQ

- 10. Conclusion: A Cautious Approach to the Real Estate Wealth Network

The login process for the Real Estate Wealth Network is straightforward, but a closer inspection reveals some potential pitfalls. Upon visiting the network’s website, users are prompted to click the “Login” button, typically found in the top right corner. From there, they are required to enter their registered email address and password to securely access their account.

While the login mechanism itself is relatively simple, the real challenge lies in the initial account creation process. New users must provide detailed personal and investment-related information, including their name, contact details, and investment experience. This level of data collection raises questions about the network’s data privacy and security practices, an aspect that savvy investors should scrutinize before entrusting their sensitive information.

What Is Real Estate Wealth Network

What Is Real Estate Wealth Network

Uncovering the Motivated Seller Data Feed: A Double-Edged Sword?

At the heart of the Real Estate Wealth Network lies the Motivated Seller Data Feed, a resource that claims to provide access to a wealth of valuable property information. This tool, which taps into a vast database of foreclosures, tax liens, vacancies, and more, promises to help investors identify the most promising off-market deals.

While the ability to access such comprehensive data may seem like a game-changer, a critical analysis reveals potential drawbacks. For one, the accuracy and reliability of the data feed have been the subject of ongoing debates within the real estate investment community. Investors should exercise caution when relying solely on this resource, as outdated or incomplete information could lead to costly missteps.

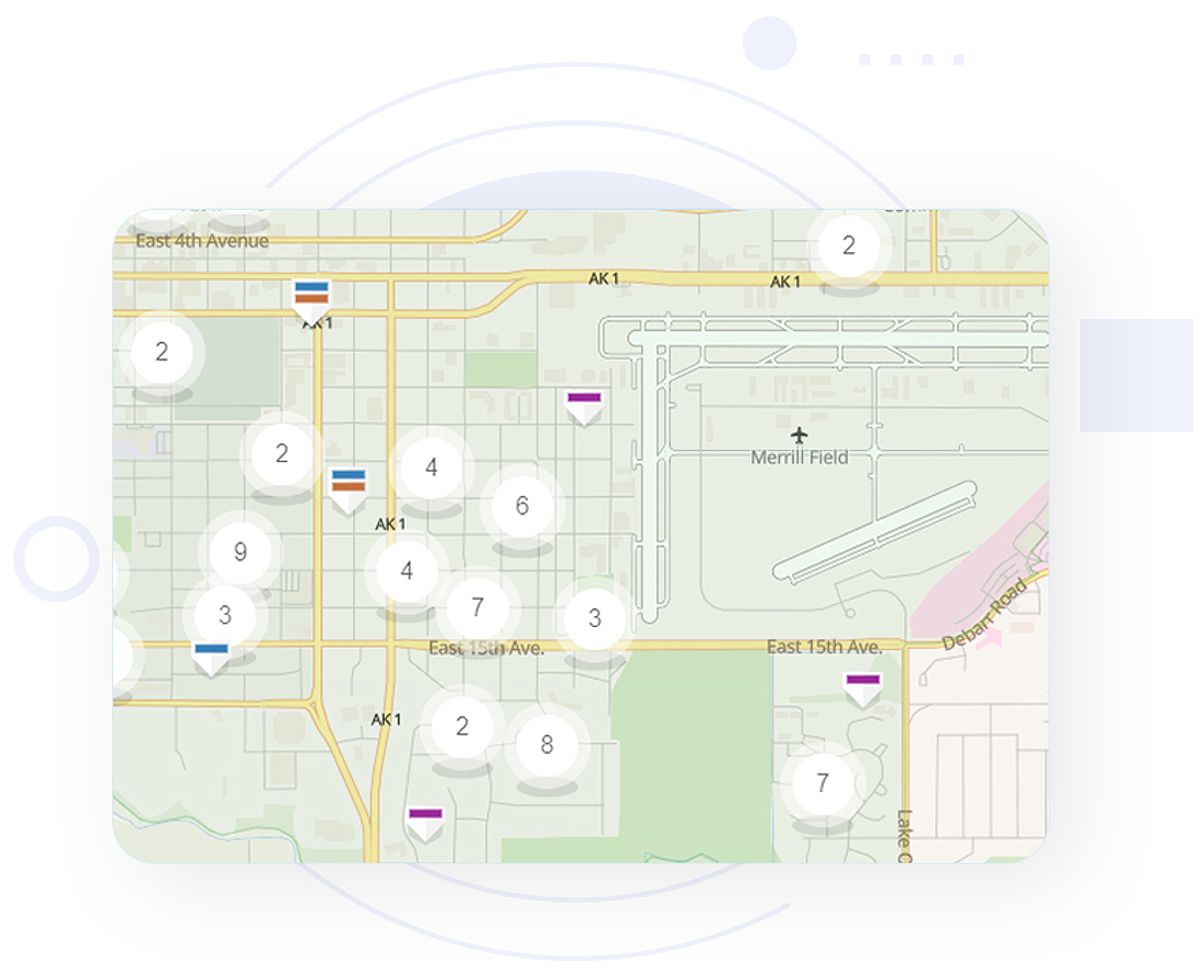

Moreover, the platform’s search capabilities, although touted as advanced, may not be as user-friendly or intuitive as claimed. The ability to customize search criteria and leverage heatmaps to identify hot markets is certainly valuable, but the learning curve associated with navigating these features could be a deterrent for some investors.

Intuitive Search Ability

Intuitive Search Ability

1. https://goldnews24h.com/archive/4720/

2. https://goldnews24h.com/archive/4758/

3. https://goldnews24h.com/archive/4701/

Streamlining or Complicating? A Closer Look at iFlip

The Real Estate Wealth Network also offers iFlip, a real estate business management software intended to streamline various aspects of an investor’s operations. From automating marketing efforts to managing deals and generating detailed reports, iFlip promises to be a one-stop solution for real estate professionals.

However, the true value of iFlip lies in its seamless integration with the network’s other resources, such as the Motivated Seller Data Feed. This interconnectivity can be a double-edged sword, as it may inadvertently create a reliance on the network’s ecosystem, potentially limiting an investor’s flexibility and independence.

Additionally, the cost associated with iFlip’s subscription model is a factor that seasoned investors should carefully consider. While the platform may offer efficiencies, the financial investment required may not align with the budgets of all real estate professionals, particularly those in the early stages of their investment journey.

More Built-In Extras

More Built-In Extras

Evaluating Cameron Dunlap’s Inner Circle: Exclusive or Elitist?

One of the Real Estate Wealth Network’s most exclusive offerings is the Cameron Dunlap’s Inner Circle, a personalized mentorship program that provides direct access to the network’s founder and his team of seasoned real estate professionals. This program promises live training sessions, a searchable knowledge base, and unlimited personal support.

While the idea of receiving personalized guidance from an experienced investor like Cameron Dunlap may be enticing, the exclusivity of the Inner Circle raises questions about accessibility and inclusivity. The application process and potential membership fees may create barriers for some investors, potentially excluding those who could benefit most from such a program.

Furthermore, the collective wisdom and insights shared within the Inner Circle may not always align with the unique challenges and market conditions faced by individual investors. Relying too heavily on the guidance provided within this exclusive community could lead to a narrow perspective and potentially limit an investor’s ability to think independently and adapt to changing market dynamics.

Real Estate Wealth Network: A Comprehensive Evaluation

As with any comprehensive platform, the Real Estate Wealth Network presents a mixed bag of potential benefits and drawbacks for real estate investors. Understanding these nuances is crucial for making an informed decision about whether the network aligns with your investment goals and risk tolerance.

Pros:

- Access to a vast database of property information through the Motivated Seller Data Feed

- Opportunities for streamlining business operations with the iFlip software

- Potential for personalized guidance and support through Cameron Dunlap’s Inner Circle

- Vibrant community of fellow investors for networking and knowledge sharing

Cons:

- Concerns about the accuracy and reliability of the Motivated Seller Data Feed

- Potential learning curve and user-friendliness issues with the platform’s features

- Subscription fees for the network’s advanced tools and services, which may be prohibitive for some investors

- Exclusivity and potential elitism associated with the Cameron Dunlap’s Inner Circle

Real Estate Wealth Network Features

Real Estate Wealth Network Features

For real estate investors seeking to enhance their strategies and gain a competitive edge, the Real Estate Wealth Network may hold some appeal. However, a cautious and critical approach is advisable when evaluating the platform’s offerings. Here are some tips to consider:

1. https://goldnews24h.com/archive/4743/

2. https://goldnews24h.com/archive/4720/

3. https://goldnews24h.com/archive/4722/

- Prioritize independent research: Conduct thorough due diligence on the Real Estate Wealth Network, exploring reviews, industry forums, and credible sources to form a balanced perspective.

- Scrutinize data accuracy: Validate the reliability and timeliness of the Motivated Seller Data Feed before relying on it for critical investment decisions.

- Evaluate cost-benefit ratios: Carefully weigh the potential benefits of the network’s tools and services against the associated subscription fees to ensure a worthwhile investment.

- Maintain investment independence: While the personalized guidance of the Inner Circle may be enticing, strive to retain a diverse range of perspectives and avoid over-reliance on a single source.

- Embrace a dynamic approach: Stay adaptable and open to exploring alternative resources and strategies that may better align with your unique investment goals and market conditions.

FAQ

Q: Does the Real Estate Wealth Network cater to all types of real estate investments? A: The network claims to support a wide range of real estate investment strategies, including wholesaling, flipping, rental properties, and land investment. However, investors should carefully evaluate the suitability of the platform’s tools and resources for their specific investment focus.

Q: Is the Motivated Seller Data Feed available nationwide? A: According to the network, the Motivated Seller Data Feed covers a majority of markets across the United States. However, it’s crucial for investors to verify the availability and coverage for their specific geographic areas of interest.

Q: How can I assess the reliability of the data provided by the Real Estate Wealth Network? A: Conducting independent market research, cross-referencing the data with other credible sources, and validating the information through field experience can help investors assess the reliability and accuracy of the network’s data offerings.

Q: What are the key requirements for joining Cameron Dunlap’s Inner Circle? A: The Inner Circle is typically open to experienced real estate investors who have demonstrated a proven track record of success. Prospective members may be required to provide evidence of past deals or investment experience to be considered for the program.

Conclusion: A Cautious Approach to the Real Estate Wealth Network

The Real Estate Wealth Network presents a complex and multifaceted proposition for real estate investors. While the platform offers a range of tools, resources, and personalized guidance, a critical examination reveals potential pitfalls and limitations that savvy investors must consider before committing to the network.

Before diving into the Real Estate Wealth Network, it is essential to approach the platform with a discerning and cautious mindset. Conduct thorough research, validate the accuracy and reliability of the data, and carefully weigh the cost-benefit ratios of the network’s offerings. Maintain a diverse range of perspectives and avoid over-reliance on a single source, even if it promises personalized mentorship.

By adopting a critical and independent approach, real estate investors can navigate the Real Estate Wealth Network with greater awareness and make informed decisions that align with their unique investment goals and risk tolerances. The path to real estate success may not be a one-size-fits-all solution, but a dynamic and adaptable strategy that leverages the best resources while preserving investment independence.