Navigating the Best Small Business Liability Insurance in 2024

Toc

As a thriving small business owner in 2024, you understand the importance of safeguarding your hard-earned success. Imagine a scenario where a customer trips and falls in your store, or a client sues you for a mistake in your service – these unexpected events can be truly devastating if you don’t have the right liability insurance coverage in place.

In this comprehensive guide, we’ll delve into the world of best small business liability insurance and explore the key factors you need to consider to protect your business from financial ruin. Whether you’re running a local retail shop, a service-based consultancy, or a small-scale manufacturer, this article will equip you with the knowledge and strategies to make an informed decision and secure the perfect liability policy for your unique needs.

Why Small Business Liability Insurance is a Game-Changer

Liability insurance plays a crucial role in shielding your small business from the financial repercussions of accidents, injuries, property damage, or claims of negligence. Without adequate coverage, a single incident could potentially lead to costly lawsuits, legal expenses, and the risk of your personal assets being on the line.

Maintaining the right liability insurance not only protects your business’s reputation and credibility but also ensures you can continue your operations without the threat of financial ruin. Whether you’re facing a customer slip-and-fall or a product-related lawsuit, having the appropriate liability coverage can make all the difference in weathering unexpected challenges and preserving your hard-earned success.

Exploring the Different Types of Liability Coverage

As a small business owner, you may require various types of liability insurance to address your unique risks. Let’s dive into the key coverages you should consider:

General Liability Insurance: Your First Line of Defense

General liability insurance is a fundamental coverage for most small businesses, protecting against claims of bodily injury, property damage, and personal injury (such as libel or slander). This policy covers common risks like customer accidents, slip-and-falls, and property damage, making it an essential safeguard for businesses with frequent customer interaction.

Product Liability Insurance: Safeguarding Your Offerings

If your small business manufactures, distributes, or sells products, product liability insurance is a must-have. This coverage protects against claims related to defective products, injuries, or damages caused by the items you offer. From food producers to retailers, this specialized liability policy is vital for businesses that could face product-related lawsuits.

Professional Liability Insurance: Shielding Your Expertise

For small businesses that provide professional services, such as consultants, accountants, lawyers, or healthcare providers, professional liability insurance (also known as errors and omissions insurance) is essential. This coverage safeguards against claims of negligence, errors, or omissions in the delivery of your professional services, helping to protect your business from costly legal battles.

Key Factors to Consider When Choosing the Best Small Business Liability Insurance

When selecting the right liability insurance policy for your small business, several critical factors should guide your decision:

Coverage Limits: Determining the Right Level of Protection

Understanding coverage limits is crucial, as it directly relates to the level of protection your business receives. Higher liability limits provide greater financial protection, but they also come with higher premiums. Consider the maximum potential liability your business could face and choose limits that offer adequate coverage without straining your budget.

Deductibles: Finding the Optimal Balance

The deductible is the amount you’ll pay out-of-pocket before your insurance coverage kicks in. Higher deductibles generally lead to lower premiums, but make sure to choose a deductible you can comfortably afford in the event of a claim.

Insurer Reputation and Financial Stability: Choosing a Trusted Partner

Selecting a reputable and financially sound insurance provider is essential. Research the insurer’s history, financial ratings, and customer reviews to ensure they have a proven track record of paying claims promptly and fairly.

Policy Exclusions: Understand the Limitations

Carefully review the policy exclusions to understand what situations are not covered. Exclusions can vary significantly between insurers, so it’s crucial to ensure the policy covers the specific risks your small business faces.

Price and Value: Finding the Right Balance

While cost is an important consideration, don’t prioritize the cheapest policy if it lacks adequate coverage. Aim to find a balance between price and the overall value the policy offers in terms of protection and risk management.

Strategies to Save on Small Business Liability Insurance

Maintaining the right liability insurance coverage doesn’t have to break the bank. Here are some practical tips to help you save money on your small business insurance premiums:

-

Implement Risk Management Practices: Take proactive steps to mitigate potential liability risks, such as improving safety protocols, providing employee training, and maintaining a well-organized workplace. This can demonstrate to insurers that your business is a lower-risk investment.

-

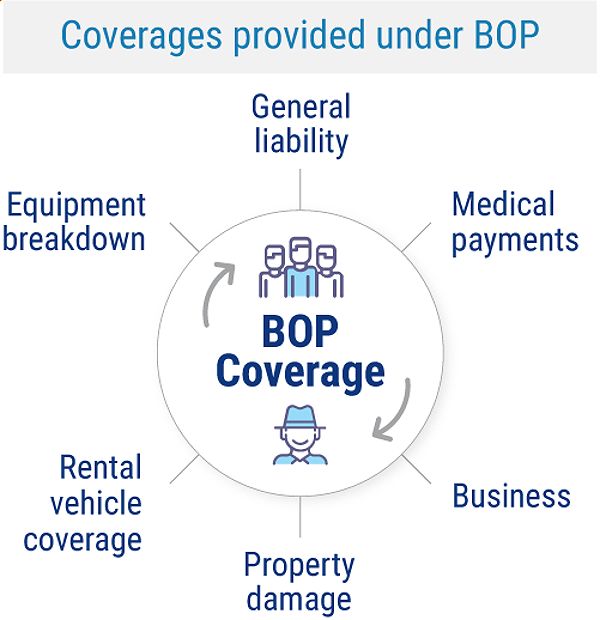

Bundle Multiple Policies: Consider bundling your liability insurance with other necessary coverages, such as property or workers’ compensation, to take advantage of potential discounts from the same insurer.

-

Increase Your Deductible: Opting for a higher deductible can significantly reduce your monthly or annual premiums, but be sure to choose an amount you can comfortably afford in the event of a claim.

-

Shop Around and Compare Quotes: Don’t settle for the first quote you receive. Reach out to multiple insurers and independent agents to compare rates and coverage options, ensuring you get the best value for your small business.

-

Negotiate with Your Insurer: If you’ve been a loyal customer or have a positive claims history, don’t be afraid to negotiate with your insurer for potential discounts or more favorable terms.

Reducing Liability Risks for Your Small Business

In addition to purchasing the right liability insurance coverage, there are proactive steps you can take to minimize your small business’s liability risks:

Implement Robust Safety Protocols

Regularly review and update your workplace safety procedures, ensuring you have measures in place to prevent accidents and injuries. This could include providing proper training for employees, maintaining a clean and organized work environment, and addressing any potential hazards promptly.

Screen Employees Thoroughly

Thorough background checks and reference verifications can help you avoid hiring individuals who may pose a liability risk to your business. This is especially important for roles that involve direct customer interaction or the handling of sensitive information.

Carefully Vet Third-Party Vendors

When working with contractors, suppliers, or other third-party service providers, ensure they have the appropriate liability coverage and that their business practices align with your own risk management standards.

Stay Up-to-Date with Regulations

Familiarize yourself with the latest industry regulations and compliance requirements, and make sure your small business is consistently meeting these standards. This can help you avoid potential fines or legal issues down the line.

FAQ

Q: What is the average cost of small business liability insurance? A: The cost of small business liability insurance can vary widely based on factors like industry, business size, coverage limits, and location. However, the typical range is between $40 to $100 per month.

Q: How often should I review my liability insurance policy? A: It’s recommended to review your small business liability insurance policy annually. This allows you to ensure the coverage still meets your needs and explore potential cost-saving opportunities as your business evolves.

Q: What happens if I don’t have liability insurance and a customer gets injured on my property? A: Without liability insurance, you could be held personally liable for the damages, medical expenses, and legal fees associated with the incident. This can potentially lead to significant financial losses and even bankruptcy, putting your small business at risk.

Conclusion

As a small business owner, you understand the importance of anticipating and mitigating risks. Investing in comprehensive liability insurance is a critical step in securing the long-term success and stability of your company. By following the strategies and guidance outlined in this comprehensive guide, you’ll be well on your way to finding the best small business liability insurance solution to safeguard your operations and give you peace of mind.

Remember, the right liability coverage can mean the difference between weathering unexpected challenges and facing financial ruin. Take the time to carefully evaluate your options, implement risk management practices, and partner with a reputable insurance provider. With the proper protection in place, you can focus on growing your business with confidence, knowing your hard work is shielded from the unexpected.