As a licensed insurance agent with over a decade of experience, I’ve witnessed the challenges that many seniors face when trying to secure affordable life insurance, especially those with pre-existing health conditions. It’s a heartbreaking reality that so many individuals in their golden years are denied coverage or forced to pay exorbitant premiums simply because of their medical history. But I’m here to tell you that there is a glimmer of hope, and that hope comes in the form of AARP Life Insurance.

Toc

In June 2024, I had the privilege of working with a client named Emily, a vibrant 72-year-old woman who had been struggling to find life insurance coverage for years. Emily had a history of heart disease and diabetes, and traditional insurers had repeatedly turned her away or offered policies with premiums that were simply out of reach. That is, until she discovered AARP Life Insurance.

Guaranteed Acceptance: A Lifeline for Seniors with Pre-existing Conditions

One of the standout features of AARP Life Insurance is its guaranteed acceptance policies, which are designed specifically for seniors like Emily who may struggle to qualify for traditional life insurance. These policies eliminate the need for medical exams or intrusive health questions, providing a much-needed safety net for those with pre-existing conditions.

AARP Easy Acceptance Life Insurance

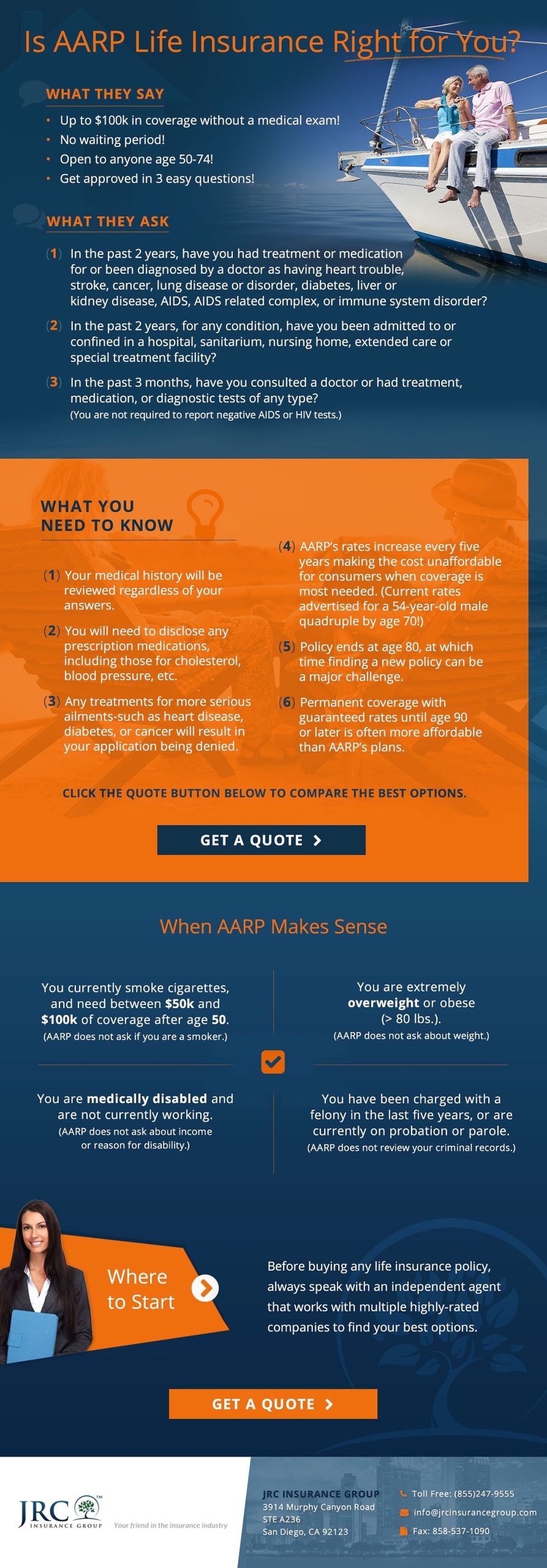

AARP Life Insurance Analysis

AARP Life Insurance Analysis

Emily opted for AARP’s Easy Acceptance Life Insurance policy, which offered her up to $25,000 in coverage without any medical requirements. While the coverage amount may be lower compared to other options, the peace of mind it provided Emily was invaluable. With fixed premiums that would never increase, she knew that she could maintain this policy for the rest of her life, ensuring that her family would be taken care of.

AARP Level Benefit Term Life Insurance

In addition to the Easy Acceptance policy, AARP also offers a Level Benefit Term Life Insurance plan that provides coverage up to $100,000. While this policy does involve a medical questionnaire, it can be a viable option for seniors with less severe health issues. Unfortunately, Emily’s extensive medical history made it challenging for her to qualify for this higher-coverage option.

Tailored Coverage for a Variety of Needs

AARP Life Insurance understands that seniors have diverse financial needs, which is why they offer a range of coverage options, including term life and whole life policies.

Term Life Insurance

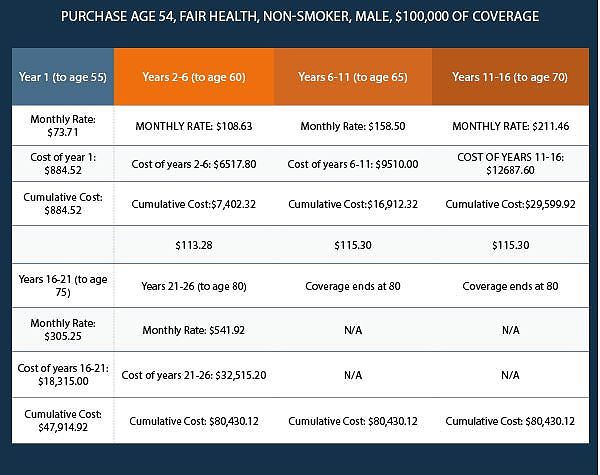

Purchase-age-54-fair-health-non-smoker-male-100000-of-coverage

Purchase-age-54-fair-health-non-smoker-male-100000-of-coverage

For Emily, the affordability of AARP’s Term Life Insurance was a significant factor. The premiums were generally lower than whole life policies, which allowed her to maintain the coverage she needed without stretching her retirement budget too thin. While the coverage period is limited, this option was well-suited for Emily’s temporary financial obligations, such as outstanding debts.

Whole Life Insurance

AARP company logo

AARP company logo

In contrast, AARP’s Whole Life Insurance policies provide lifelong coverage, with premiums that remain fixed and guaranteed never to increase. These policies also build cash value over time, which can be accessed if needed. While the premiums may be higher, the peace of mind of permanent coverage was appealing to Emily.

Rider Benefits

One of the aspects of AARP Life Insurance that impressed Emily the most were the optional rider benefits, such as the Accelerated Death Benefit and Waiver of Premium for Nursing Home Stays. These riders provided an extra layer of financial protection, ensuring that she and her family would be taken care of in the event of a terminal illness or extended nursing home stay.

As with any life insurance policy, the cost and affordability of AARP’s offerings were crucial considerations for Emily. While AARP may be a convenient option, it’s essential to compare premiums across different providers to ensure you’re getting the best value.

Purchase-age-54-fair-health-non-smoker-%22standardstandard-plus%22-rate-class-male-100000-of-coverage

Purchase-age-54-fair-health-non-smoker-%22standardstandard-plus%22-rate-class-male-100000-of-coverage

When Emily and I reviewed the premium rates for AARP Life Insurance, we found that they were generally higher than those offered by other insurers, such as Mutual of Omaha. However, the peace of mind and accessibility of AARP’s guaranteed acceptance policies made it a worthwhile investment for Emily.

Factors Affecting Premiums

It’s important to note that the premiums for life insurance can be influenced by a variety of factors, including age, health status, coverage amount, and policy type. By maintaining a healthy lifestyle, exploring available discounts, and comparing quotes from multiple insurers, Emily was able to secure a policy that fit her budget and provided the coverage she needed.

Exploring Alternatives

While AARP Life Insurance proved to be the best solution for Emily, I always encourage my clients to explore alternative providers that cater to seniors with pre-existing conditions. Companies like Mutual of Omaha, Colonial Penn, and others have also developed guaranteed acceptance policies that may offer more competitive rates or higher coverage amounts.

By comparing the options from various insurers, Emily was able to make an informed decision that aligned with her specific needs and financial situation. The key is to approach the process with an open mind and a willingness to explore all available options.

FQAs

Q: Can I get life insurance if I have a pre-existing condition? A: Yes, you can still get life insurance with a pre-existing condition. However, it might be more difficult to qualify for traditional policies, and you might have to pay higher premiums. Guaranteed acceptance policies like those offered by AARP are designed for seniors with health issues.

Q: What are the advantages of AARP Life Insurance for seniors with pre-existing conditions? A: AARP offers guaranteed acceptance policies that eliminate the need for medical exams and health questions, making it easier for seniors with pre-existing conditions to get coverage.

Q: What are the disadvantages of AARP Life Insurance? A: AARP’s guaranteed acceptance policies may have lower coverage amounts and higher premiums compared to traditional policies.

Q: How can I find the best life insurance policy for my specific needs? A: It’s essential to compare quotes from multiple insurers, including those specializing in guaranteed acceptance policies. Consider your coverage needs, budget, and health status when making your decision.

Conclusion

As an insurance agent, I’ve seen firsthand the transformative impact that AARP Life Insurance can have on the lives of seniors with pre-existing conditions. For Emily, the guaranteed acceptance policies and the range of coverage options provided her with the peace of mind and financial protection she so desperately needed.

While AARP Life Insurance may not be the most affordable option on the market, the convenience and accessibility it offers can be invaluable for those who have struggled to secure coverage elsewhere. By taking the time to explore all available options and compare premiums, you can find the life insurance policy that best suits your unique needs and budget.

Remember, your health and your family’s future are worth the investment. Don’t let pre-existing conditions stand in the way of securing the financial protection you deserve. Contact me today to embark on your own personal journey with AARP Life Insurance and take the first step towards a more secure future.