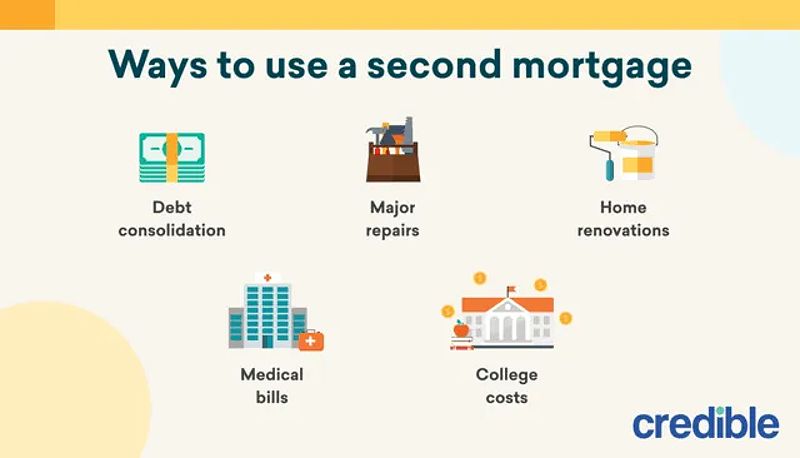

The recent increase in interest rates has left many homeowners searching for solutions to manage their high-interest debt. A second mortgage loan presents itself as an option, allowing borrowers to consolidate debts into a potentially lower-interest payment. However, the added monthly expense and risk of foreclosure must be carefully considered before pursuing this route.

Toc

- 1. Understanding Second Mortgage Loans for Debt Consolidation

- 2. The Pros and Cons of Using a Second Mortgage Loan

- 3. Types of Second Mortgages: HELOCs vs- Home Equity Loans

- 4. Related articles 01:

- 5. Qualifying for a Second Mortgage Loan: Key Factors

- 6. Second Mortgage Loan vs- Refinancing: Making the Right Choice

- 7. Managing Your Second Mortgage Loan Successfully

- 8. Frequently Asked Questions (FAQ)

- 9. Current Trends in Second Mortgage Lending

- 10. Conclusion

- 11. Related articles 02:

Understanding Second Mortgage Loans for Debt Consolidation

A second mortgage loan is a financial tool that enables you to leverage the equity in your home to consolidate high-interest debts, such as credit card balances or personal loans. By securing a loan second mortgage, you may access lower interest rates than those typically associated with unsecured debts. This can lead to substantial savings over time.

For instance, consider a scenario where you have accumulated $30,000 in credit card debt with an average annual percentage rate (APR) of 18%. If you secure a second mortgage loan at an interest rate of 8%, you could consolidate that debt into a single monthly payment that is not only more manageable but also significantly less costly over the life of the loan.

Calculating Borrowing Power Based on Home Equity

The amount you can borrow through a mortgage loan 2nd is primarily determined by your home equity, which is the difference between your home’s current market value and the outstanding balance on your first mortgage. Lenders typically allow you to borrow up to 80-85% of your home’s equity, although this can vary based on the lender and your financial profile.

Additionally, lenders consider the Loan-to-Value (LTV) ratio, which is the loan amount divided by the appraised value of the home. A lower LTV ratio (e.g., 70% or less) is generally preferred by lenders as it reduces their risk. The appraisal process is crucial and can impact the amount a borrower can borrow. The borrower might need to pay for an independent appraisal.

Your credit score also plays a crucial role in determining the terms of your loan. A higher credit score (usually 660 or above) can help you secure a more favorable interest rate. Conversely, if your credit score is lower, you may still qualify for a 2nd mortgage loan, but at a higher interest rate due to the increased risk perceived by lenders.

The Pros and Cons of Using a Second Mortgage Loan

Utilizing a second mortgage loan for debt consolidation comes with distinct advantages and disadvantages:

Advantages:

- Lower Interest Rates: Compared to credit cards and personal loans, second mortgage loans generally offer lower interest rates, which can save you money over time.

- Simplified Payment Structure: Instead of managing multiple payments, you consolidate your debts into a single monthly payment, simplifying your financial obligations.

- Potential Tax Benefits: Interest paid on a second mortgage loan used for home improvements may be tax-deductible (consult a tax professional for specifics).

Disadvantages:

- Increased Monthly Payments: Although you may save on interest, your monthly payments could increase due to the additional loan.

- Risk of Foreclosure: Since your home serves as collateral, failing to make payments could lead to foreclosure.

- Reduced Home Equity: Borrowing against your home’s equity means you will have less ownership in your property.

- Potential Impact on Credit Scores: Missed payments or maxing out credit lines can significantly lower your credit score, making it harder to secure future loans.

Types of Second Mortgages: HELOCs vs- Home Equity Loans

When considering a second mortgage loan, it’s essential to understand the two primary options available: Home Equity Loans (HELOANs) and Home Equity Lines of Credit (HELOCs).

Home Equity Loans (HELOANs)

HELOANs provide a lump-sum payment with fixed interest rates and repayment terms, typically ranging from 5 to 30 years. This makes them suitable for one-time debt consolidation, as you will know exactly how much you are borrowing and what your monthly payments will be.

Home Equity Lines of Credit (HELOCs)

In contrast, HELOCs function like a credit card, allowing you to access a revolving line of credit that can be drawn upon as needed. They usually come with variable interest rates and a draw period (typically 5-10 years) followed by a repayment period. This flexibility is advantageous if your borrowing needs are ongoing or uncertain, such as for home improvement projects.

Key Differences Between HELOANs and HELOCs

| Feature | Home Equity Loan (HELOAN) | Home Equity Line of Credit (HELOC) |

|---|---|---|

| Loan Type | Lump-sum payment | Revolving line of credit |

| Interest Rate | Fixed | Variable |

| Repayment Terms | 5-30 years | Draw period (5-10 years) + Repayment period |

| Best For | One-time debt consolidation | Ongoing borrowing needs (e.g., home improvements) |

When deciding between a HELOAN and a HELOC, assess your specific financial goals and borrowing requirements. HELOANs are ideal for clear, one-time needs, while HELOCs offer the flexibility to adapt to changing financial circumstances.

1. https://goldnews24h.com/archive/5165/

2. https://goldnews24h.com/archive/5149/

3. https://goldnews24h.com/archive/5115/

Qualifying for a Second Mortgage Loan: Key Factors

Lenders evaluate several key factors when determining your eligibility for a second mortgage loan:

Credit Score

A good credit score is essential for securing a second mortgage loan. Scores of 660 or higher are typically favored, as they indicate a lower risk to lenders. If your score is below this threshold, you may still qualify, but expect to face higher interest rates.

Debt-to-Income Ratio (DTI)

Your DTI is the percentage of your monthly income that goes toward debt payments, including your first and second mortgage. Lenders generally prefer a DTI of 43% or lower. To improve your chances of approval, consider reducing existing debt and increasing your income.

Home Equity

To qualify for a second mortgage, you usually need a minimum of 15-20% equity in your home. This is calculated by subtracting your current mortgage balance from your home’s estimated market value.

Income and Employment Stability

Stable income and a solid employment history are critical factors that lenders consider. Consistent, verifiable income enhances your ability to manage the additional monthly payments associated with a second mortgage loan.

Additional Considerations

Other factors that may influence your approval include the loan-to-value (LTV) ratio, appraisal value, and the lender’s specific requirements. Understanding these criteria can help you prepare for a successful application.

Second Mortgage Loan vs- Refinancing: Making the Right Choice

When contemplating how to access your home’s equity, you have two primary options: a second mortgage loan or a cash-out refinance. The right choice depends on your financial goals and circumstances.

When to Choose a Second Mortgage Loan

Opt for a second mortgage if:

- Your current first mortgage has a favorable interest rate that you wish to maintain.

- You only need to borrow a smaller amount for debt consolidation.

When to Consider Refinancing

A cash-out refinance might be a better fit if:

- You are dealing with a high-interest first mortgage and want to take advantage of lower rates.

- You need to borrow a larger sum, such as for extensive home renovations.

While refinancing may involve higher closing costs than a second mortgage, the potential benefits of lower interest rates and the ability to borrow larger sums should be carefully considered.

Managing Your Second Mortgage Loan Successfully

If you decide to proceed with a second mortgage loan, consider these practical tips for effective management:

- Budget for Additional Payments: Incorporate the second mortgage payment into your monthly budget to ensure that you can comfortably manage the new obligation.

- Create a Debt Repayment Plan: Develop a strategy to pay off the second mortgage as quickly as possible. This could include making extra payments or applying any unexpected windfalls toward the balance.

- Monitor Your Credit Reports: Regularly check your credit report to ensure the second mortgage is accurately reported and that your credit score remains healthy.

- Understand the Loan Terms: Thoroughly review the loan agreement to comprehend the interest rate, repayment schedule, and any associated fees or penalties.

- Seek Professional Advice: Consulting a financial advisor or mortgage specialist can help you navigate the complexities of a second mortgage loan, ensuring it is the right fit for your situation.

Frequently Asked Questions (FAQ)

Q: What are the typical closing costs for a second mortgage loan?

A: Closing costs can vary but usually range from 2% to 5% of the loan amount, including fees for appraisals, title insurance, and other processing expenses.

Q: Can I deduct the interest on my second mortgage loan?

A: Potentially, but only if the loan proceeds are used for home improvements. Consult a tax professional for tailored advice.

Q: What happens if I can’t make my second mortgage payments?

A: Failing to make payments can lead to foreclosure. It’s essential to explore options like loan modification or refinancing before reaching that point. Contact your lender immediately if you face difficulties.

Q: How long does it take to get approved for a second mortgage loan?

A: The approval process generally takes several weeks, depending on the lender and the complexity of your application.

Q: What is the difference between a 2nd mortgage and a home equity loan?

A: While often used interchangeably, a home equity loan is a specific type of second mortgage. A second mortgage encompasses various loan types secured by home equity.

Current Trends in Second Mortgage Lending

The rising popularity of online lenders has introduced more competitive interest rates for second mortgage loans. Additionally, stricter lending regulations in recent years have impacted approval rates and loan terms, making it essential for borrowers to carefully review their options and qualifications.

Conclusion

A second mortgage loan can be an effective tool for consolidating high-interest debt, but it is vital to understand the associated terms, risks, and responsibilities. Weigh the benefits against the potential drawbacks, ensuring you can comfortably manage the additional monthly payments. By planning carefully and seeking professional advice when necessary, you can utilize a second mortgage loan to achieve your financial goals responsibly. Reach out to a reputable lender today to explore your options and learn more about securing a second mortgage loan tailored to your needs.

1. https://goldnews24h.com/archive/5156/

2. https://goldnews24h.com/archive/5153/

3. https://goldnews24h.com/archive/5117/