A single mother, struggling to afford her child’s medical bills, explored a low credit home equity loan to cover unexpected expenses. She discovered navigating the process required careful planning, thorough research, and a willingness to explore alternative financing if necessary. This guide outlines the steps to successfully pursue a low credit home equity loan.

Toc

- 1. Understanding Low Credit Home Equity Loans and Their Risks

- 2. Eligibility Criteria for a Low Credit Home Equity Loan

- 3. Related articles 01:

- 4. Finding the Right Lender for a Low Credit Home Equity Loan

- 5. Strategies to Improve Your Chances of Approval

- 6. Alternative Financing Options if a Home Equity Loan is Denied

- 7. Related articles 02:

- 8. Frequently Asked Questions (FAQ)

- 9. Conclusion

Understanding Low Credit Home Equity Loans and Their Risks

A low credit home equity loan allows homeowners to borrow against the equity in their property, even if their credit score isn’t perfect. This type of loan is particularly appealing to those facing financial challenges, as it can provide access to funds for various needs, from medical bills to home repairs.

Definition and Mechanics of a Home Equity Loan

A home equity loan is essentially a second mortgage, where the equity in your home acts as collateral. This means that if you fail to repay the loan, the lender has the right to foreclose on your property. Unlike unsecured personal loans, home equity loans typically offer lower interest rates due to the collateral involved.

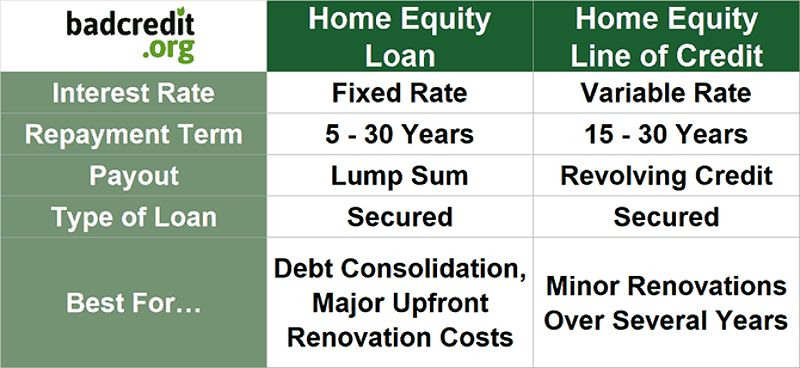

Comparison with Personal Loans and HELOCs

While a home equity loan provides a lump sum of cash at a fixed interest rate, a Home Equity Line of Credit (HELOC) allows you to draw on your equity as needed, similar to a credit card. HELOCs often come with variable interest rates, which can fluctuate over time. Personal loans, on the other hand, are unsecured and usually have higher interest rates, making them less desirable for those with bad credit.

Risks of Default and Foreclosure

One of the primary risks associated with a low credit home equity loan is the potential for foreclosure. If you default on the loan, the lender can seize your home. It’s crucial to assess your financial situation and ensure that you can afford the monthly payments before committing to this type of loan. However, lenders often work with borrowers facing financial hardship through loan modifications or forbearance programs, providing a potential path forward.

Eligibility Criteria for a Low Credit Home Equity Loan

When applying for a home equity loan with low credit score, various factors will influence your eligibility. Understanding these criteria can help you prepare for a successful application.

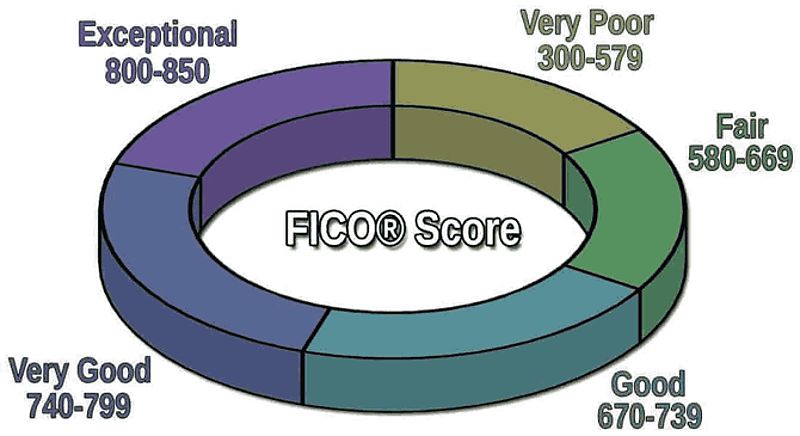

Credit Score Impact

Your credit score plays a significant role in determining your eligibility for a low credit home equity loan. A FICO score between 620 and 679 is considered fair, and lenders may offer loans, but at higher interest rates (potentially 1-3% above prime). Scores below 620 are considered subprime, dramatically increasing interest rates and potentially requiring larger down payments or private mortgage insurance (PMI). While many lenders prefer a minimum score of 620, some may consider borrowers with scores as low as 500.

Debt-to-Income Ratio (DTI)

Your DTI is a critical metric that lenders use to assess your ability to repay the loan. This ratio compares your total monthly debt payments to your gross monthly income. For instance, if your gross monthly income is $5,000 and your total monthly debt payments are $1,500, your DTI is 30%. Lenders generally prefer a DTI below 43%, but this can vary based on the lender and the type of loan. Ideally, lenders prefer a DTI of 43% or less, but some may allow higher ratios if other factors, such as home equity and credit score, are strong.

To improve your DTI, consider strategies like paying off high-interest debts or increasing your income through side jobs or promotions.

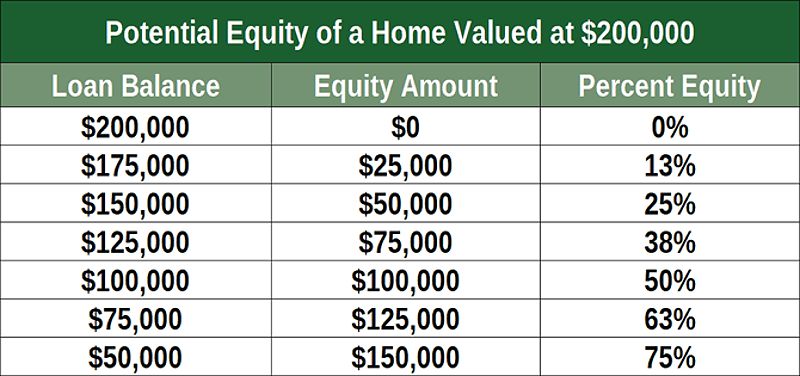

Home Equity

The equity you have in your home is a crucial factor in securing a home equity loan no credit check. Equity is calculated as the difference between your home’s current market value and the remaining balance on your mortgage. Most lenders allow you to borrow up to 80% of your home’s equity, although some may offer higher limits depending on your financial situation.

To determine your equity, you can get a professional appraisal or use online home value estimators. Understanding your equity will give you a clearer picture of how much you can borrow.

1. https://goldnews24h.com/archive/5152/

2. https://goldnews24h.com/archive/5164/

3. https://goldnews24h.com/archive/5149/

Income Verification

Lenders will require income verification to ensure you can repay the loan. Acceptable forms of documentation may include pay stubs, tax returns, or bank statements. Be prepared to present this information during your application process.

Loan-to-Value (LTV) Ratio

The Loan-to-Value ratio is another essential factor that lenders consider. This ratio is calculated by dividing the loan amount by the appraised value of your home. A lower LTV ratio indicates less risk for the lender, which can improve your chances of securing a fair credit home equity loan.

Finding the Right Lender for a Low Credit Home Equity Loan

Finding a lender willing to work with you despite your low credit score is crucial. Here are some strategies to help you identify potential lenders.

Traditional Banks vs- Online Lenders

Your existing bank or credit union may be more inclined to approve your application due to your established relationship. They may offer special programs or reduced fees for existing customers. However, the rise of fintech lenders has increased competition, potentially offering more options for borrowers with less-than-perfect credit.

Understanding Loan Terms

When comparing lenders, be sure to understand the interest rates, fees, and repayment terms. The Federal Reserve’s recent interest rate increases have significantly impacted borrowing costs, making home equity loans more expensive than they were previously. Borrowers should carefully consider the long-term implications of higher interest rates on their monthly payments.

Avoiding Predatory Lending Practices

While searching for lenders, be cautious of predatory lenders who may offer loans with exorbitant interest rates or hidden fees. These lenders often target individuals with low credit scores, putting them in an even worse financial position.

Pre-Qualification Options

Some lenders provide pre-qualification options that allow you to check your eligibility without affecting your credit score. This can be a valuable step in determining which lenders may be willing to work with you.

Strategies to Improve Your Chances of Approval

If your credit score is on the lower side, there are several strategies you can implement to increase your chances of securing a home equity loan with low credit score.

Boosting Your Credit Score

Improving your credit score can significantly affect your loan terms. Consider these actionable steps:

- Pay all bills on time: Late payments can negatively impact your score.

- Reduce credit card balances: Aim to keep your utilization below 30%.

- Dispute errors: Regularly check your credit report for inaccuracies and dispute any errors.

While improving credit scores is beneficial, it’s a long-term strategy and may not immediately qualify someone for a loan.

Reducing Debt-to-Income Ratio

Lowering your DTI can make you more appealing to lenders. Strategies include:

- Debt consolidation: Combine high-interest debts into a single loan with a lower interest rate.

- Create a budget: Monitor your expenses and identify areas where you can cut back.

Considering a Co-Signer

If possible, find a creditworthy co-signer to strengthen your application. A co-signer with a solid credit history can improve your chances of approval and potentially secure a lower interest rate.

Exploring Cash-Out Refinancing

As an alternative to a traditional home equity loan, consider cash-out refinancing. This option replaces your existing mortgage with a new, larger one, allowing you to access your home equity. However, be aware that this may require you to meet different eligibility criteria.

Alternative Financing Options if a Home Equity Loan is Denied

If a traditional home equity loan isn’t feasible, several alternative financing options may be available.

Home Equity Line of Credit (HELOC)

A HELOC functions as a revolving line of credit that allows you to access your home’s equity as needed. While it may have more flexible credit requirements than a home equity loan, be mindful of the variable interest rates that can change over time.

Personal Loans

If you’re unable to secure a home equity loan, personal loans may be an option. Though they typically come with higher interest rates than home equity loans, they may be more accessible for borrowers with bad credit.

1. https://goldnews24h.com/archive/5155/

2. https://goldnews24h.com/archive/5156/

3. https://goldnews24h.com/archive/5109/

Home Equity Investment Agreements

Companies like Hometap offer home equity investment agreements, allowing you to access a portion of your home’s equity in exchange for a share of the future value of your property. While these agreements often have lower credit score requirements, they come with their own set of pros and cons.

Frequently Asked Questions (FAQ)

Q: Can I get a home equity loan with a credit score below 620?

A: Yes, it is possible to secure a home equity loan with a credit score below 620, but it may be more challenging. Lenders will consider factors such as your DTI and home equity, and expect higher interest rates.

Q: What if I’m denied a home equity loan?

A: If denied, consider alternatives like a HELOC or personal loans. You can also work on improving your credit score and reapply later.

Q: What documents do I need for a home equity loan?

A: Generally, you will need proof of income, a recent home appraisal, and your mortgage statement. Check with your lender for specific requirements.

Q: How long does the application process take?

A: The application process typically takes 2 to 4 weeks, but this can vary based on the lender and your financial situation.

Q: Are there any fees associated with a home equity loan?

A: Yes, expect to pay closing costs, appraisal fees, and possibly other charges. These can range from 2% to 6% of the total loan amount.

Conclusion

Securing a low credit home equity loan may seem daunting, but with the right approach, it can be a viable option for many homeowners. By understanding eligibility criteria, improving your financial standing, and exploring alternative financing options, you can increase your chances of success.

Remember to thoroughly research lenders, understand the risks involved, and choose the option that best fits your financial situation. Start your journey towards accessing your home’s equity today!