Imagine the financial repercussions of a coding error that costs your client thousands. Errors and omissions insurance quotes can help you find the coverage you need to protect your IT business from potentially devastating lawsuits and financial losses.

Toc

- 1. Understanding the Importance of Errors and Omissions Insurance for IT Professionals

- 2. Types of Errors and Omissions Insurance

- 3. Factors Affecting Errors and Omissions Insurance Quotes

- 4. Related articles:

- 5. Protecting Your Business from E&O Claims

- 6. Common Exclusions in Errors and Omissions Policies

- 7. Frequently Asked Questions

- 7.1. What is the difference between errors and omissions insurance and professional liability insurance?

- 7.2. How much does errors and omissions insurance typically cost for IT professionals?

- 7.3. Do I need errors and omissions insurance if I have cyber liability insurance?

- 7.4. What happens if I make a mistake that causes a client to lose money?

- 7.5. How can I find the best errors and omissions insurance quotes for my IT business?

- 8. Conclusion

In the ever-evolving technology landscape, errors and omissions insurance has become a critical safeguard for IT professionals. As an experienced IT service provider, you understand the importance of delivering reliable solutions to your clients. However, even the most meticulous experts can make mistakes, and the consequences can be financially devastating. That’s why obtaining the right errors and omissions insurance coverage is a strategic move that can make all the difference in safeguarding your IT business.

Understanding the Importance of Errors and Omissions Insurance for IT Professionals

The IT industry is fraught with potential liabilities, from complex coding errors to data breaches and contract disputes. A single oversight or technical glitch can result in significant financial losses for your clients, leading to costly lawsuits. In fact, a study by the International Data Corporation found that small and medium-sized IT businesses face an average of $21,000 in legal costs per incident.

The threat of liability is omnipresent, with the Ponemon Institute reporting an average cost of $2.98 million for data breaches affecting small businesses. Moreover, the American Bar Association has revealed that more than 40% of IT professionals have been sued for professional negligence. These staggering statistics underscore the crucial need for comprehensive E&O insurance coverage.

Types of Errors and Omissions Insurance

E&O insurance, also known as professional liability insurance, provides a crucial safety net for IT professionals. This coverage protects your business from the financial repercussions of claims related to professional negligence, errors, and omissions.

General E&O Insurance

Smiling business owner at a counter

Smiling business owner at a counter

This basic coverage safeguards your business against lawsuits stemming from professional negligence, errors, and omissions, such as coding mistakes or missed deadlines.

Cyber Liability Insurance

Average errors and omissions insurance premiums for Insureon customers by industry

Average errors and omissions insurance premiums for Insureon customers by industry

This policy addresses the unique risks of data breaches and cyberattacks, covering the costs of notifying affected clients, recovering lost data, and defending against related legal actions.

Tech E&O Insurance

Business owner weighing insurance risks and options

Business owner weighing insurance risks and options

This comprehensive package combines general E&O coverage with robust cyber liability protection, providing a holistic solution for IT professionals.

By carefully evaluating the specific needs of your IT business, you can determine the most suitable E&O insurance coverage to mitigate a wide range of risks.

Factors Affecting Errors and Omissions Insurance Quotes

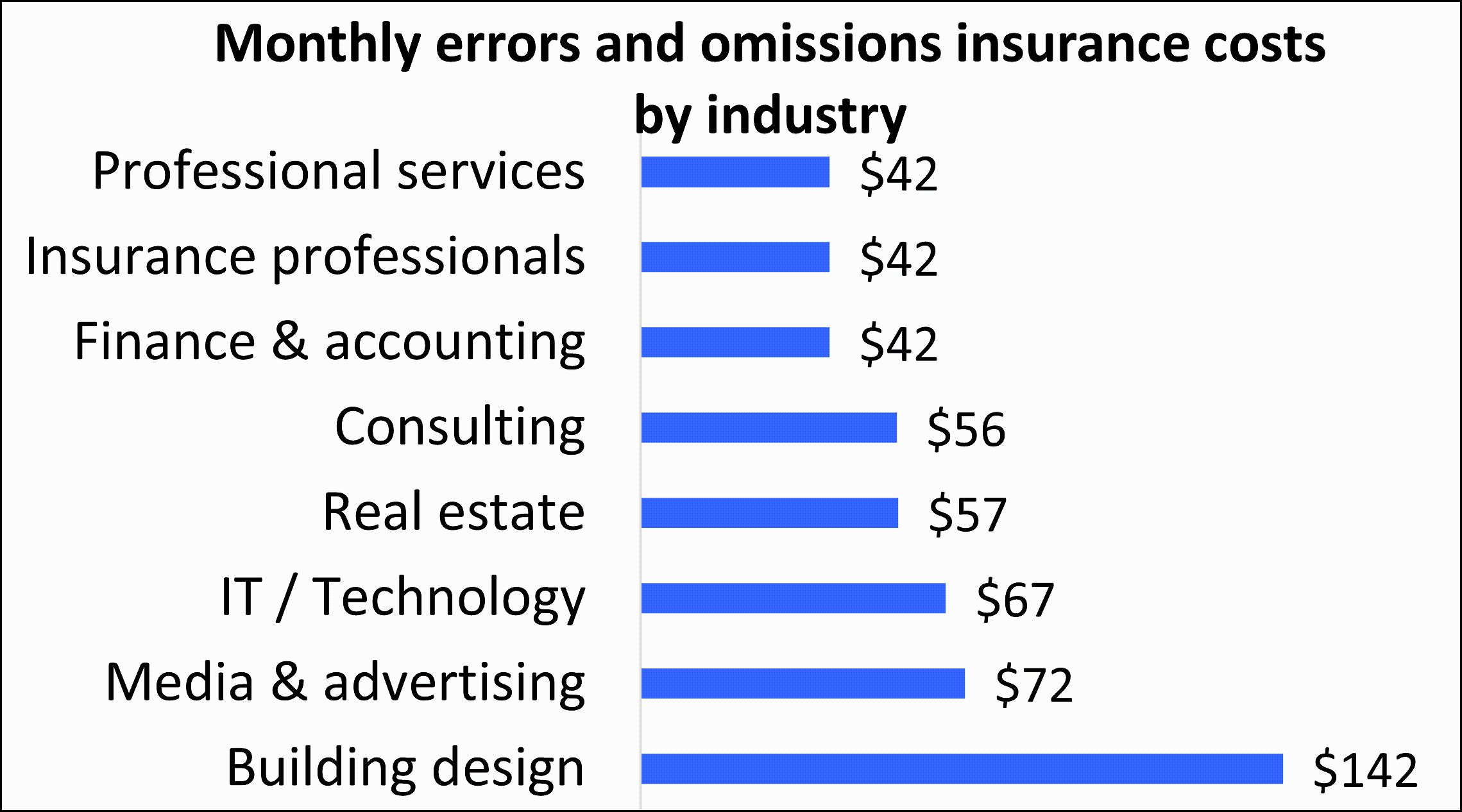

The cost of your E&O insurance will depend on various factors, including the level of risk associated with your IT services, the size of your business, your claims history, and the coverage limits you choose.

Understanding these key drivers can help you optimize your E&O insurance premiums. For example, by maintaining a clean claims record and implementing robust cybersecurity measures, you can demonstrate a lower risk profile, potentially securing more favorable E&O insurance quotes. Similarly, adjusting your coverage limits and deductibles can also impact the overall cost of your policy.

Protecting Your Business from E&O Claims

In addition to securing the right E&O insurance coverage, IT professionals can proactively manage their risk exposure through a combination of best practices and client relationships.

Best Practices for Risk Management

Business owner thinking about cost factors

Business owner thinking about cost factors

Adopting effective risk management strategies can significantly reduce the likelihood of E&O claims. This includes:

- Maintaining clear communication with clients to set realistic expectations

- Drafting detailed contracts with a clear scope of work

- Diligently documenting all project-related activities

- Conducting regular security audits and updates

- Providing employee training on cybersecurity and ethical practices

By implementing these measures, you can demonstrate your commitment to delivering high-quality services and minimizing the potential for mistakes or oversights.

Building Strong Client Relationships

Fostering trust and positive relationships with your clients is equally vital in mitigating E&O risks. By being responsive, proactive, and going the extra mile to exceed their expectations, you can cultivate a sense of goodwill that makes clients less inclined to pursue legal action over minor issues.

Common Exclusions in Errors and Omissions Policies

While E&O insurance provides comprehensive protection, it’s essential to understand the common exclusions in these policies. Typically, E&O coverage does not extend to claims arising from intentional misconduct, fraud, prior acts (unless specifically covered), bodily injury or property damage, employee criminal acts, or cyberattacks.

Carefully reviewing the policy language and exclusions can help you identify any potential gaps in your coverage and ensure you have the appropriate supplementary policies in place, such as cyber liability insurance or fidelity bonds.

Frequently Asked Questions

What is the difference between errors and omissions insurance and professional liability insurance?

Errors and omissions insurance and professional liability insurance are essentially the same type of coverage, with different industries using distinct terminology to refer to it.

How much does errors and omissions insurance typically cost for IT professionals?

The cost of E&O insurance for IT professionals can vary widely, ranging from approximately $33 per month to $200 per month or more, depending on factors like business size, industry risk, and coverage limits.

Do I need errors and omissions insurance if I have cyber liability insurance?

While cyber liability insurance covers data breaches and cyberattacks, it does not protect against all the risks associated with professional negligence, such as coding errors or contract disputes. E&O insurance provides an additional layer of protection for IT professionals.

What happens if I make a mistake that causes a client to lose money?

If your mistake or oversight results in financial losses for a client, they may pursue legal action against your business. Your E&O insurance policy will cover the legal defense costs, as well as any settlements or judgments awarded to the client, up to the limits of your coverage.

How can I find the best errors and omissions insurance quotes for my IT business?

To obtain the most suitable E&O insurance coverage at a competitive price, compare quotes from multiple reputable providers, either directly or through an online insurance marketplace. Additionally, consider partnering with an independent insurance broker who specializes in serving the IT industry.

Conclusion

In the dynamic world of technology, errors and omissions insurance is a vital safeguard for IT professionals. By understanding the unique risks you face, the factors that influence E&O insurance costs, and the strategies for managing liability, you can protect your business from the devastating financial consequences of a lawsuit.

Take the proactive step in safeguarding your IT company by requesting personalized E&O insurance quotes from trusted providers. With the right coverage in place, you can confidently deliver exceptional services to your clients, knowing that your business is shielded from the perils of professional negligence.