Many entrepreneurs believe startups should avoid debt, but strategic use of working capital loans can be a powerful tool for growth. By providing access to funds when needed, these loans can help startups bridge cash flow gaps, invest in marketing, and even weather unexpected challenges. Learn how to get working capital loans for small business and unlock your company’s potential.

Toc

- 1. Understanding Working Capital

- 2. Types of Working Capital Loans for Small Businesses

- 3. Related articles 01:

- 4. Fintech Lending: A Changing Landscape

- 5. How to Get Working Capital Loans for Small Business

- 6. Related articles 02:

- 7. Managing Working Capital Effectively

- 8. Frequently Asked Questions

- 9. Conclusion

Understanding Working Capital

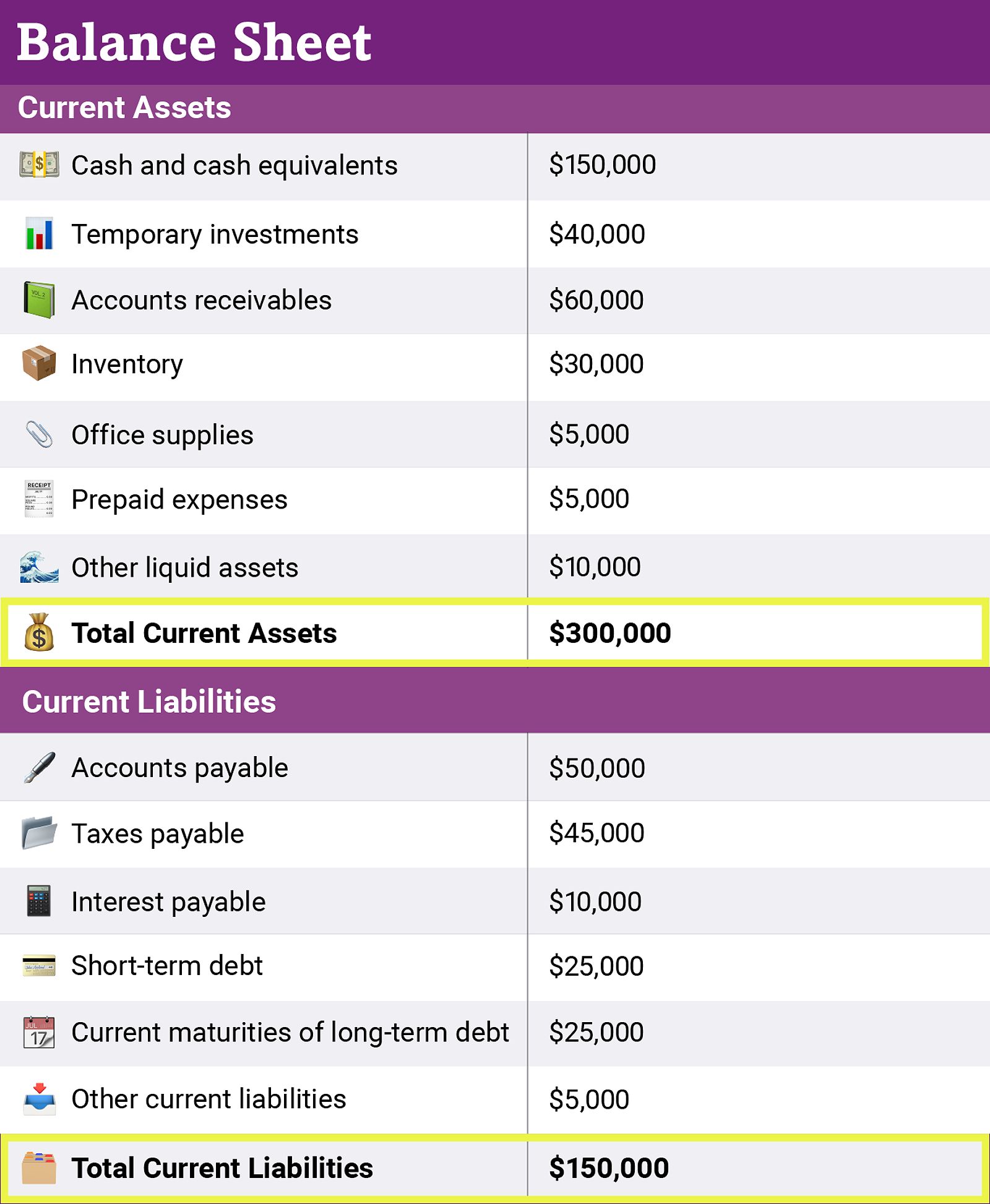

To truly understand how to get working capital loans for small business, it’s essential to grasp what working capital is and why it matters. Working capital refers to the funds available to a business for its day-to-day operations. It’s calculated as the difference between current assets (like cash and accounts receivable) and current liabilities (such as accounts payable and short-term debts).

Understanding Working Capital

For small businesses, maintaining adequate working capital is vital for smooth operations. It enables you to manage cash flow effectively, pay bills on time, and take advantage of growth opportunities. Without sufficient working capital, you may find yourself struggling to meet financial obligations or unable to invest in critical areas of your business.

Signs Your Business Needs Working Capital

Understanding when your business needs additional funding is critical for both its survival and its potential for growth. Here are some common indicators that it might be time to seek a working capital loan:

- Frequent Cash Flow Shortages: If you often find yourself waiting for payments while needing to cover immediate expenses, it may be time to consider a working capital loan.

- Difficulty Meeting Payment Obligations: Struggling to pay your vendors or employees can signal that your working capital is insufficient.

- Limited Funds for Growth Initiatives: If you have great ideas for marketing campaigns or product launches but lack the funds to execute them, a working capital loan could help.

- Seasonal Fluctuations: If your business experiences seasonal peaks and troughs, working capital loans can help you manage expenses during slower months.

- Unexpected Expenses: Sudden costs, such as equipment repairs or emergency inventory purchases, can strain your finances, making a working capital loan necessary.

Additionally, businesses can assess their working capital needs by analyzing metrics like the Current Ratio and Quick Ratio. These financial ratios provide a more quantitative understanding of a company’s liquidity and ability to cover short-term obligations.

Types of Working Capital Loans for Small Businesses

When looking to get working capital loans for small business, you’ll find several options available, each with its unique features.

Term Loans

Term loans provide a lump sum of cash that you repay over a set period through regular installments. These loans are suitable for businesses with a solid credit history and a clear plan for how to use the funds. Advantages include typically lower interest rates compared to other options, while disadvantages may include collateral requirements and a lengthy application process.

Equipment Financing

Equipment financing is a specific type of term loan that allows businesses to purchase essential equipment, such as machinery or vehicles, by using the equipment itself as collateral. This option can be particularly beneficial for businesses that require specialized equipment to operate and grow.

1. https://goldnews24h.com/archive/5164/

2. https://goldnews24h.com/archive/5117/

3. https://goldnews24h.com/archive/5111/

Lines of Credit

A business line of credit allows you to access funds as needed, up to a pre-approved limit. This flexibility is ideal for businesses with fluctuating cash flow needs, as you only pay interest on the amount borrowed. However, be cautious—lines of credit can come with high interest rates if not managed properly.

Invoice Financing

With invoice financing, you can access cash upfront by selling your unpaid invoices to a lender at a discounted rate. This method is particularly beneficial for businesses with many outstanding invoices, providing quick access to working capital. However, be aware that invoice financing often carries higher interest rates than traditional loans.

Merchant Cash Advances

Merchant cash advances offer a lump sum in exchange for a percentage of future sales. This option can be fast and accessible, even for businesses with less-than-perfect credit. However, these loans usually come with high interest rates, which can create financial strain if your sales are unpredictable.

SBA Loans

Small Business Administration (SBA) loans are government-backed options that provide more affordable terms, including lower interest rates and longer repayment periods. These loans are a great choice for businesses with limited credit history, although the application process can be more time-consuming compared to other financing options.

Fintech Lending: A Changing Landscape

The rise of financial technology (Fintech) has significantly impacted the small business lending landscape. Fintech lenders often offer faster and more accessible working capital loans, leveraging alternative data sources beyond traditional credit scores to assess creditworthiness. For example, platforms like Kabbage and BlueVine provide revenue-based financing, where loan amounts are based on a business’s sales and cash flow rather than just its credit profile.

How to Get Working Capital Loans for Small Business

Securing a working capital loan is not just about filling out an application; it involves a proactive approach. Here are some essential steps to increase your chances of getting the funding you need:

Build a Strong Credit Score

A good credit score is vital when applying for a working capital loan. Improving your credit involves paying bills on time, keeping your credit utilization low, and regularly checking your credit reports for errors. That said, lenders are increasingly considering alternative credit data, such as business revenue and cash flow, in addition to traditional credit scores.

Develop a Compelling Business Plan

Lenders will want to see a well-structured business plan that showcases your startup’s viability and growth potential. Your plan should include key components such as an executive summary, market analysis, competitive overview, financial projections, and management team details.

Gather Required Documentation

Be prepared to provide various documents to lenders, including personal and business tax returns, bank statements, financial statements, proof of identity, and your business license. Having these materials organized will make the application process smoother.

Shop Around for the Best Rates

Don’t settle for the first loan offer you receive. Compare terms and interest rates from multiple lenders to find the best deal for your business. Consider using online loan marketplaces or working with a business loan broker to simplify the comparison process.

Leverage Relationship Banking

Building strong relationships with lenders can also improve your chances of securing a working capital loan. Maintaining open communication, demonstrating financial responsibility, and establishing a track record with a particular bank or financial institution can make the application process more favorable.

1. https://goldnews24h.com/archive/5155/

2. https://goldnews24h.com/archive/5152/

3. https://goldnews24h.com/archive/5114/

Managing Working Capital Effectively

Once you secure a working capital loan, managing that capital effectively is crucial for long-term financial stability. Here are some practical tips:

- Create a Cash Flow Forecast: A cash flow forecast helps you identify potential gaps in funding, allowing you to plan accordingly. Analyze historical data and consider seasonal fluctuations to create accurate forecasts.

- Monitor Accounts Receivable: Timely payments from customers are essential for maintaining healthy cash flow. Implement clear payment terms, send timely invoices, and follow up on overdue accounts to improve your collections.

- Negotiate Favorable Payment Terms: Work with suppliers and vendors to negotiate better payment terms. Request extended payment periods or discounts for early payments to improve your cash flow.

- Optimize Inventory Levels: Managing your inventory effectively can minimize storage costs and prevent stockouts. Use inventory tracking systems and forecast demand accurately to maintain optimal levels.

- Track Expenses Closely: Keeping a close eye on your expenses and creating a detailed budget can help you control costs. Utilize accounting software to categorize expenses and analyze spending patterns.

- Review Financial Performance Regularly: Schedule regular reviews of your financial performance to identify trends, areas for improvement, and opportunities for growth. This proactive approach can help you stay on top of your financial health.

Frequently Asked Questions

What are the typical interest rates for working capital loans for small businesses?

Interest rates can vary widely based on the lender, loan type, and your business’s creditworthiness. According to industry data, the average annual percentage rate (APR) for small business working capital loans ranges from 7% to 30%, with the lower end typically reserved for businesses with excellent credit and financial profiles.

How long does it take to get a working capital loan?

The timeline for securing a working capital loan varies. Online Fintech lenders often offer faster funding than traditional banks, with some approving and funding loans within a few business days. However, be prepared for longer wait times with SBA loans due to their more extensive application process, which can take several weeks to several months.

What are the common eligibility requirements for working capital loans for small businesses?

Typical requirements include a good credit score, a solid business plan, financial statements, proof of identity, and a valid business license. While these are common criteria, lenders are increasingly considering alternative data points like revenue and cash flow when evaluating loan applications.

Conclusion

Securing working capital loans can be a crucial step in fueling your small business’s growth and achieving long-term financial stability. By understanding the different loan options available, building strong relationships with lenders, and effectively managing your working capital, you can position your business for success. Start exploring your options today and unlock the potential for your business to thrive!