Millions of homeowners tap into their home equity annually, but securing a home equity loan can be a complex process. Understanding credit scores, debt-to-income ratios, and loan-to-value ratios is essential. This guide explains how to get a home equity loan, outlining the steps to secure favorable terms and avoid common mistakes. We’ll cover everything from loan qualification to comparing lender offers, empowering you to make informed decisions.

Toc

- 1. Understanding Home Equity and Loans

- 2. Qualifying for a Home Equity Loan: How to Get a Home Equity Loan by Meeting Lender Requirements

- 3. Related articles 01:

- 4. Finding the Best Home Equity Loan: Shopping Around and Comparing

- 5. Using Your Home Equity Loan Wisely: Responsible Borrowing

- 6. Related articles 02:

- 7. Frequently Asked Questions

- 8. Conclusion

Understanding Home Equity and Loans

A home equity loan is a type of second mortgage that allows you to access the equity you’ve built up in your home. Equity refers to the portion of your home’s value that you actually own, which is the difference between the home’s current market value and the outstanding balance on your primary mortgage. By using your home as collateral, you can borrow a lump sum of money at a fixed interest rate, typically lower than the rates on unsecured loans.

What Is Home Equity?

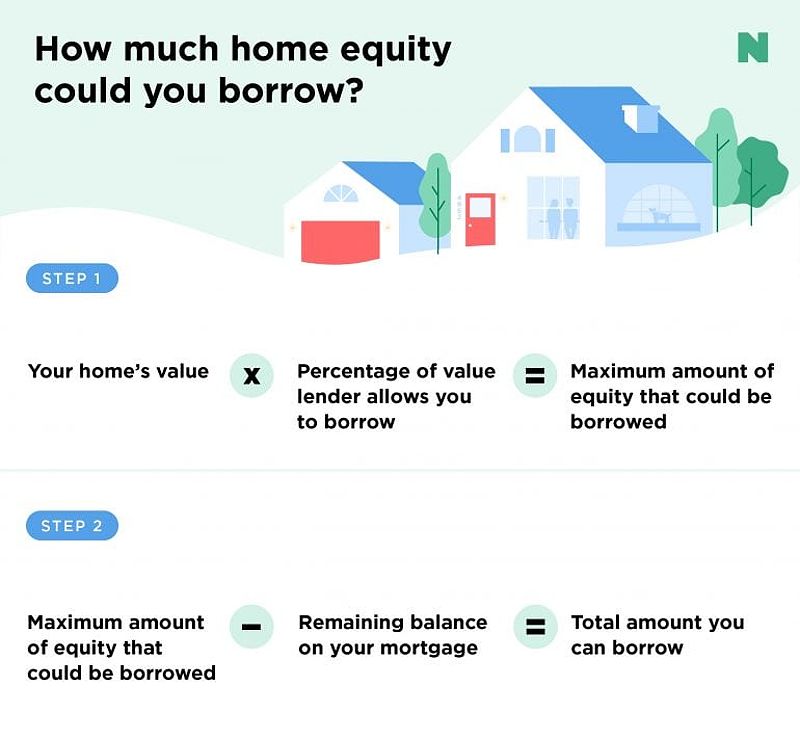

Home equity is essentially the amount of your home that you truly own. It can be calculated using the formula:

Home Equity = Current Market Value of Home – Outstanding Mortgage Balance – Property Taxes Owed – Upcoming Insurance Premiums

It’s important to note that your accessible equity isn’t solely determined by the simple formula. Outstanding property taxes and homeowner’s insurance premiums often reduce the amount a lender will consider when assessing your loan application. For instance, if you owe $5,000 in property taxes and have $2,000 in upcoming insurance premiums, your available equity for a loan would be reduced by $7,000 from the initial calculation.

How Home Equity Loans Work

Unlike a Home Equity Line of Credit (HELOC), which provides a revolving line of credit, a home equity loan gives you a one-time, fixed-rate loan. This means you’ll receive the full amount at closing and repay it over a set period, usually between 5 to 30 years, with predictable monthly payments.

Home Equity Loans vs- HELOCs and Cash-Out Refinances

-

Home Equity Loan vs. HELOC: A HELOC offers more flexibility, allowing you to borrow as needed, up to your approved limit. In contrast, a home equity loan provides a lump-sum payout with fixed rates and repayment terms. While a HELOC’s flexibility is appealing, it’s important to note that many HELOCs offer variable interest rates, meaning your monthly payments could fluctuate based on market conditions.

-

Home Equity Loan vs. Cash-Out Refinance: A cash-out refinance replaces your existing mortgage with a new one, potentially changing your interest rate and loan terms. In contrast, a home equity loan leaves your primary mortgage unchanged, allowing you to keep your existing rate.

Understanding these distinctions is crucial as you consider how to get a home equity loan that best fits your financial situation.

Qualifying for a Home Equity Loan: How to Get a Home Equity Loan by Meeting Lender Requirements

To qualify for a home equity loan, lenders generally look for a few key factors:

Credit Score

Lenders typically require a credit score of at least 620. However, a higher score can significantly improve your chances of securing better rates and terms. A score above 740 is often considered excellent and may yield the most favorable conditions.

Debt-to-Income (DTI) Ratio

Lenders will assess your DTI ratio to ensure you can manage the additional debt. This ratio compares your total monthly debt payments to your gross monthly income. Most lenders prefer a DTI ratio below 43%, though some may consider borrowers with ratios as high as 50%. To calculate your DTI, use the formula:

DTI = (Total Monthly Debt Payments / Gross Monthly Income) x 100

Loan-to-Value (LTV) Ratio

Lenders will assess the value of your home compared to the amount you owe on your primary mortgage to determine how much equity you have. Typically, you’ll be able to borrow up to 80-85% of your home’s value, minus your existing mortgage balance.

Employment Stability

Beyond credit score and DTI, lenders heavily weigh employment stability. A consistent work history of at least two years, ideally in the same profession, significantly strengthens your application. Conversely, frequent job changes or gaps in employment can raise red flags, impacting your approval odds and potentially leading to higher interest rates.

1. https://goldnews24h.com/archive/5164/

2. https://goldnews24h.com/archive/5109/

3. https://goldnews24h.com/archive/5165/

Home Equity Percentage

Most lenders require you to have at least 15-20% equity in your home based on the current market value. This means if your home is worth $300,000, you should ideally have at least $45,000 to $60,000 in equity.

Improving Your Chances of Approval

If your finances aren’t quite where you’d like them to be, consider taking steps to improve your credit score, pay down existing debts, and increase your home equity. These efforts can significantly boost your chances of securing the best home equity loan terms.

Finding the Best Home Equity Loan: Shopping Around and Comparing

When it comes to getting a home equity loan, it’s crucial to shop around and compare offers from multiple lenders. It’s important to understand that current interest rates are dynamic. Recent fluctuations in the market mean that securing the most favorable terms requires diligent comparison shopping across multiple lenders. Don’t just rely on your current mortgage provider; explore options from banks, credit unions, and online lenders. Each lender may have different interest rates, fees, and loan terms, so it’s important to get a full understanding of what each one is offering.

Key Factors to Compare

-

Interest Rates: Look for the lowest fixed interest rate you can find. This will determine your monthly payments and the total amount of interest you’ll pay over the life of the loan.

-

Fees: Be on the lookout for origination fees, closing costs, and any other charges associated with the loan. These can significantly impact the overall cost.

-

Loan Terms: Consider the repayment period, which typically ranges from 5 to 30 years. Longer terms will result in lower monthly payments, but you’ll pay more in interest over time.

-

Lender Type: Weigh the pros and cons of working with a bank, credit union, or online lender. Each may offer different rates, fees, and customer service experiences. Online lenders have also emerged as a significant player, offering competitive rates and a streamlined digital application process.

How to Compare Offers Effectively

Once you’ve gathered the necessary information, create a side-by-side comparison of the loan offers to identify the best fit for your needs and budget. Remember to read the fine print and fully understand all the terms and conditions before making a decision. Consider using online comparison tools or consulting with a financial advisor to help you navigate the options available.

Using Your Home Equity Loan Wisely: Responsible Borrowing

Responsible borrowing is key when it comes to home equity loans. Before taking out a loan, it’s crucial to have a clear plan for how you’ll use the funds. The most financially prudent uses for a home equity loan include:

Home Improvements

Investing in renovations or upgrades that increase the value of your home can be an excellent use of your home equity. For example, kitchen remodels and bathroom upgrades often yield high returns on investment.

Debt Consolidation

Combining high-interest debts, such as credit cards or personal loans, into a single, lower-interest home equity loan can save you money in the long run. This strategy not only simplifies your payments but can also lower your overall interest costs.

Major Purchases

While not recommended for everyday expenses, a home equity loan can be a suitable option for large, one-time purchases like a down payment on an investment property. This can be a strategic move if you are looking to expand your real estate portfolio.

Avoiding Risky Financial Decisions

Avoid using your home equity for non-essential expenses, such as vacations or luxury purchases. These types of expenses don’t contribute to your long-term financial well-being and put your home at risk if you’re unable to make the payments. Always align your borrowing with your financial goals and ensure you can comfortably manage the repayments.

1. https://goldnews24h.com/archive/5165/

2. https://goldnews24h.com/archive/5115/

3. https://goldnews24h.com/archive/5020/

While generally discouraged for business ventures, a well-structured business plan with demonstrable profitability could justify a home equity loan for business investment. However, this is a high-risk strategy, and borrowers should proceed with extreme caution.

Frequently Asked Questions

Q: What is the maximum amount I can borrow with a home equity loan?

A: The maximum amount you can borrow with a home equity loan typically ranges from 80-85% of your home’s value, minus your existing mortgage balance.

Q: Is the interest on a home equity loan tax-deductible?

A: The interest on a home equity loan may be tax-deductible if the funds are used for home improvements or certain other qualified expenses. It’s best to consult a tax professional for personalized advice.

Q: What happens if I can’t make my home equity loan payments?

A: Failure to make your home equity loan payments can lead to foreclosure, as your home is used as collateral for the loan. If you anticipate difficulties, contact your lender immediately to discuss your options.

Q: How long does the application process take?

A: The application process typically takes several weeks, depending on lender processing times and appraisal timelines. Being prepared with your documents can help speed up the process.

Q: What documents will I need?

A: Expect to provide proof of income, employment, credit history, and homeownership documentation. This may include tax returns, bank statements, and recent pay stubs.

Conclusion

Obtaining a home equity loan can be a powerful financial tool, but it’s crucial to understand the process and make informed decisions. By following the steps outlined in this guide, you can confidently navigate the world of home equity loans and secure a loan that meets your needs.

Whether you’re planning a home renovation, looking to consolidate debt, or considering a new investment, a home equity loan could be the key to unlocking your home’s hidden potential. Take the time to explore your options and make the best choice for your unique financial situation. With the right approach, a home equity loan can be a valuable tool in your personal finance toolkit. Start your journey today by researching lenders and understanding how to get a home equity loan that aligns with your financial goals.