In today’s dynamic financial landscape, personal financial investment information and strategic insight are paramount for individuals seeking to build lasting wealth. At Goldnews24h, we understand that aspiring to financial freedom or preparing for retirement requires disciplined decisions, not merely chasing ‘hot news’. One significant decision many professionals contemplate for career advancement and enhanced earning potential is pursuing a master’s degree in finance. Understanding the potential master’s degree in finance salary and the myriad opportunities it unlocks is crucial for making an informed investment in your future. This comprehensive analysis will delve into the tangible benefits and career trajectories associated with an advanced finance qualification, providing you with the data-backed clarity needed for strategic career and investment planning.

The Strategic Advantage of a Master’s in Finance

A Master of Science in Finance (MiF) or a similar graduate finance program represents a significant commitment, yet it offers a strategic advantage in a highly competitive industry. These programs go beyond the foundational knowledge of an undergraduate degree, immersing students in advanced financial concepts, analytical tools, and practical skills critical for complex decision-making. Through rigorous coursework, individuals develop expertise in areas such as financial modeling, data analysis, risk management, and intricate investment strategies. This specialized knowledge equips graduates not only to navigate but also to shape the evolving financial markets.

Beyond the classroom, a master’s in finance often provides invaluable networking opportunities, connecting students with industry leaders, potential employers, and a robust alumni network. This academic and professional enrichment serves as a catalyst for accelerated career growth, positioning graduates for roles that demand a dee. The advanced credentials gained from such a program are increasingly sought after by top-tier financial institutions, underscoring its role as a strategic investment in one’s professional capital.

Decoding the Master’s in Finance Salary Landscape

The master’s degree in finance salary landscape is diverse, influenced by a multitude of factors ranging. Graduates entering the workforce with an MiF can expect a significant uplift in their earning potential compared to those with only a bachelor’s degree. This advanced qualification signals a higher level of specialized skill and dedication, which employers are willing to compensate. Understanding these nuances is key to accurately forecasting one’s financial trajectory post-graduation.

Initial reports suggest that the average starting salary for Master of Finance graduates can range significantly, typically falling between $60,000 and $85,000 annually for entry-level positions, with higher potential in competitive sectors. However, this figure often serves as a baseline, with substantial growth potential as experience accrues. The overall median annual wage for business and financial occupations was $80,920 in May 2024, but those with advanced degrees often command figures well above this average. The investment in a master’s degree is primarily aimed at securing roles that offer both substantial initial compensation and a steep upward salary curve.

Key Roles and Their Compensation

A master’s in finance opens doors to an array of specialized and highly compensated roles within the financial industry. For instance, investment bankers, who help companies raise capital and advise on strategic financial decisions, can expect an average annual salary around $118,333, with some base salaries starting at $100,000 and significant bonuses adding to the total compensation. Senior Financial Analysts, vital for guiding business and individual investment decisions through data analysis, commanded a median annual wage of $99,890 in May 2023, with employment projected to grow by about 9%. While the average salary for financial managers (a broader category including portfolio managers) was about $151,510, with job growth projected at 9% by 2033. These figures underscore the robust financial rewards available to those with an advanced finance degree.

Geographical and Institutional Impact on Earnings

The geographical location and the reputation of the institution granting the master’s degree in finance also play a pivotal role in determining a graduate’s earning potential. Major financial hubs like New York, Boston, and other metropolitan areas typically offer higher salaries due to increased demand and cost of living. For example, a Masters Finance professional in New York earns an average of $102,117 annually. Furthermore, certain states, like Massachusetts, rank highly for master’s degree in finance salary.

The prestige of the university and the strength of its career services and alumni network are equally significant. Graduates from top-tier finance programs, particularly those with strong industry connections, often secure more competitive roles and higher starting salaries. For instance, some top programs have reported graduates earning average salaries well over $170,000 three years post-graduation. Schools that provide extensive hands-on experience, such as managing endowment funds or offering specialized certificates, further enhance a graduate’s marketability and potential master’s degree in finance salary.

Career Pathways and Earning Potential with an MiF

A master’s degree in finance acts as a powerful credential, opening diverse and rewarding career pathways within the financial services industry and beyond. The rigorous curriculum and specialized training equip graduates with the analytical and strategic skills necessary to excel in demanding roles that are at the core of global economic activity. This advanced education is often the gateway to positions with substantial influence and, consequently, impressive earning potential.

One of the most sought-after careers for MiF graduates is Investment Banking, where professionals advise corporations and governments on capital raising and complex transactions like mergers and acquisitions. These roles are known for their high compensation, with starting base salaries often around $100,000, complemented by significant bonuses that can elevate total compensation substantially. Another critical path is Portfolio Management, where individuals are entrusted with constructing and overseeing investment portfolios for clients or institutions. The expertise gained in an MiF program directly translates to this role, as it involves deep knowledge of asset valuation, risk assessment, and market dynamics.

Financial Analyst positions, especially at a senior level, also see considerable demand and higher salaries with an MiF. These analysts are crucial for scrutinizing financial data, evaluating investment opportunities, and providing strategic recommendations to businesses and individual investors. The median annual wage for financial analysts was nearly $100,000 in May 2023, with a positive job outlook. Risk Management is another expanding field, requiring professionals to identify, assess, and mitigate financial risks for organizations. The growing complexity of global markets and regulatory environments has fueled demand for these specialists. Lastly, the ultimate career progression can lead to executive leadership roles such as Chief Financial Officer (CFO), where responsibilities encompass overseeing all financial operations, budgeting, forecasting, and strategic financial planning for an entire organization, with median annual wages for financial managers exceeding $150,000 in May 2023.

The Return on Investment (ROI) of an Advanced Finance Degree

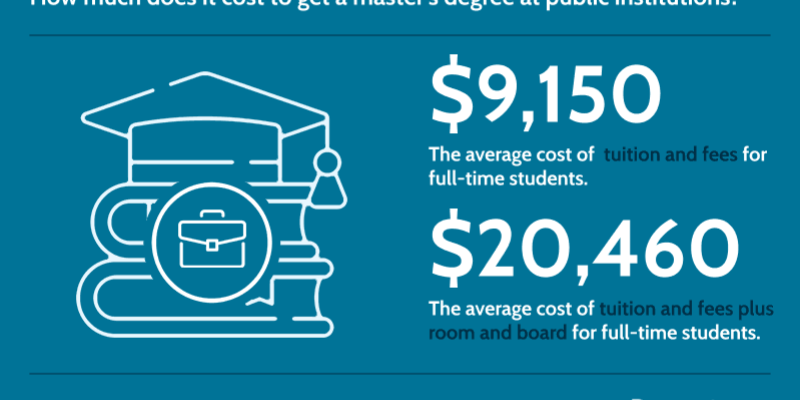

Evaluating the return on investment (ROI) for a master’s degree in finance extends far beyond the initial master’s degree in finance salary figures; it encompasses a comprehensive assessment of long-term earning potential, career progression, and enhanced professional capabilities. While the immediate costs of tuition and foregone income during study are considerable, the financial and non-financial benefits typically outweigh these initial outlays over a career lifetime. The specialized knowledge and skills acquired are not merely theoretical; they are directly applicable to complex real-world financial challenges, enabling graduates to add significant value to their organizations.

Statistics consistently show a positive ROI for master’s degrees in finance. For example, graduate degree holders generally earn significantly more than those with only bachelor’s degrees, with a median weekly pay difference that translates to hundreds of thousands of dollars over a 40-year career. A master’s in finance can effectively anchor future pay increases to a higher starting point, substantially impacting cumulative lifetime earnings. Beyond direct monetary gains, an MiF accelerates career progression, opening doors to leadership positions and more complex responsibilities sooner than peers without advanced degrees. This accelerated trajectory translates into quicker advancement up the corporate ladder and a higher ceiling for earning potential.

The ROI also includes the invaluable professional network built during the program, providing access to mentorship, collaboration opportunities, and critical industry insights that can further propel a career. Furthermore, the brand name of a reputable business school can open doors to employers and positions that might otherwise be inaccessible. As Benjamin Franklin wisely stated, “An investment in knowledge pays the best interest,” a sentiment profoundly true for a master’s degree in finance, which serves as a foundational investment in one’s intellectual and financial capital. This educational commitment is not merely about a higher salary, but about cultivating the expertise and connections essential for sustained wealth creation and financial leadership.

Navigating the Evolving Finance Job Market in 2025 and Beyond

The finance job market is in a continuous state of flux, driven by technological advancements, evolving regulatory landscapes, and shifting economic paradigms. For those considering a master’s degree in finance, understanding these trends is paramount to positioning oneself for long-term success. The outlook for business and financial occupations is generally positive, with projections indicating growth faster than the average for all occupations, particularly Artificial Intelligence (AI), automation, and machine learning. These technologies are transforming finance from process-focused roles to more strategic, data-driven positions. Repetitive tasks are increasingly being automated, allowing finance professionals to concentrate on higher-level analysis, strategic planning, and value creation. Consequently, individuals with an MiF who possess strong quantitative skills, data analytics capabilities, and proficiency in emerging financial technologies are in particularly high demand. The ability to leverage tools like blockchain and AI for tasks such as predictive analytics, personalized investment advice, and more accurate credit scoring is becoming indispensable.

The talent shortage in certain finance and accounting areas, partly due to an aging workforce, further accentuates the demand for well-qualified graduates. This environment places a premium on professionals who are adaptable, tech-savvy, and committed to continuous learning. Finance leaders in 2025 are focusing on enhancing technical expertise, strategic capabilities, and integrating modern financial systems. Therefore, pursuing a master’s degree in finance not only boosts a graduate’s immediate master’s degree in finance salary but also future-proofs their career by providing the advanced skills necessary to thrive in this rapidly evolving and technologically integrated financial ecosystem.

Conclusion

The pursuit of a master’s degree in finance is a strategic decision that can profoundly impact one’s professional trajectory and personal wealth accumulation. The analysis clearly demonstrates that a substantial master’s degree in finance salary is a tangible outcome, coupled with access to highly influential and rewarding career paths in investment banking, portfolio management, risk assessment, and financial leadership. This advanced education offers a robust return on investment, not only through enhanced compensation but also, and the development of cutting-edge skills essential for navigating the complex financial landscape of today and tomorrow.

At Goldnews24h, we advocate for investment decisions rooted in thorough analysis and clear financial objectives. Investing in a master’s degree in finance aligns perfectly with this philosophy, serving as a powerful catalyst for achieving financial freedom and long-term security. We encourage our readers, who are seriously focused on building their financial future, to consider how advanced education can be a cornerstone of their wealth management strategy. Take control of your financial destiny by investing in knowledge and expertise; explore the opportunities an advanced finance degree can unlock for you.